Silpo chain is one of the leaders of the Ukrainian food retail market, its network consists of about 300 supermarkets, and the turnover is close to UAH 60 billion.

Silpo is part of the Fozzy group, which ranks second among Ukrainian food retailers in terms of sales volume and trade area. Fozzy Group includes such networks as Silpo, Fora, Thrash! and Fozzy.

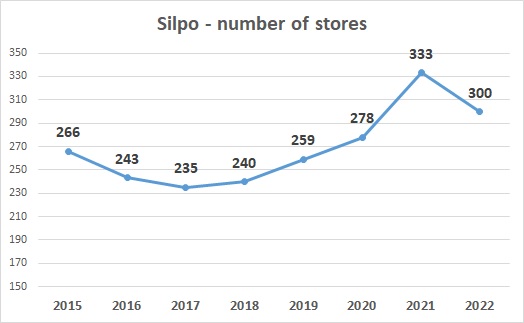

As of mid-October 2022, Silpo stores are operating in all not occupied regions of Ukraine, their total number is 300 supermarkets. The largest presence is in Kyiv, where it operates circa 100 stores.

Silpo history

The first five Silpo stores were opened in 2001, and initially, the outlets were opened in the locations of old Soviet food department stores.

The Silpo network developed quite quickly - by the end of 2002, it already amounted to 23 supermarkets, and in 2005 - 81 supermarkets. In fact, at this time, it has already become one of the market leaders.

Dynamic development continued until 2008, when the global financial crisis hit, which significantly reduced the purchasing power of the Ukrainian population, and also led to significant problems for many companies from various business areas, including food retail.

Fozzy Group in general and the Silpo network in particular cannot be named as one of those companies most affected by the crisis (primarily due to not too high debt burden), so the network only slowed down its development during the crisis years. Other competitors, such as Metro, Fourshet, Velyka Kishenya, have almost completely stopped opening new stores. Some of them went bankrupt.

So in the period from 2010 to 2013, the market leaders - Fozzy Group and ATB Market significantly increased the gap from other companies. In 2013, ATB's revenue amounted to UAH 28 billion, Fozzy's - UAH 25 billion, and its closest competitor (by the amount of revenue) - Metro - only UAH 9 billion.

About 75% of Fozzy Group's revenue was generated by the Silpo network, which at the end of 2013 already had about 240 supermarkets.

Silpo credit history

The crisis of 2014-15 and the occupation of part of the Ukrainian territory had an impact on Silpo's activities, which can be compared with 2008-09, except that as a result of the new crisis, the company entered into long and difficult negotiations on debt restructuring with the russian VTB bank.

The total amount of debt at the end of 2013 was not very big - about UAH 2.5 billion, but most of the debt was denominated in foreign currency (due to the devaluation of the hryvnia in 2014-15, it more than doubled in hryvnia equivalent). With network revenue of more than UAH 20 billion per year, this amount of debt was ok for the company's activities. At the same time, having its own problems on the Ukrainian market, VTB demanded full repayment of the debt. Difficult negotiations were held, which ended ... with the exit of VTB from the Ukrainian banking market.

Silpo gained the reputation of a tough negotiator with banks, but this did not prevent the network from getting a loan from the EBRD - the European Bank for Reconstruction and Development, which has fairly strict requirements for the credit quality of its borrowers in 2020. Silpo chain and Fozzy Group as a whole satisfied these requirements, so it can be concluded that the situation with VTB had a rather limited impact on the quality of the company as a borrower.

The conflict with VTB and the crisis again slowed down the development of the network, and in 2016-18, general optimization and restructuring of its activities began. If at the end of 2015 there were 266 Silpo supermarkets, at the end of 2017 there were already 235. Others were partially closed and partially re-branded to the newly created chain of Fozzy Group - Thrash!

New format

Not willing to enter into direct price competition with ATB Market, Silpo positioned itself as a network in the middle+ price segment. Operating largely in the Kyiv region, where the purchasing power of the population is higher than the average in Ukraine, having quite good locations for most of its supermarkets, Silpo has always had good figures of sales per unit of the trade area, even though it is not a chain with cheap prices.

The main competitor in Silpo's target segment was Novus network, which was also actively developing in the Kyiv region.

But Silpo went further - the concept of unique designer stores was created. According to this concept, each store had to carry its own story, and have its own style and design. The company tried to create a unique experience and impression for its consumers, which would distinguish itself from all other networks.

Supermarkets were opened in the style of Stalker, The Adventures of Tom Sawyer, The History of Podol, Petrykivsky Painting, and many other styles. In 2021 alone, 35 designer supermarkets were opened, and more than 100 - over the past few years. Silpo is actively implementing energy-saving and recycling technologies (this is one of the areas of cooperation with the EBRD).

Having decided on a market segment, Silpo resumed network expansion. At the end of 2019, it consisted of 258 supermarkets, in 2020 - 276, and in 2021 - 333. In 2021, Silpo took over the remnants of the Fourshet chain, which fifteen years ago was Silpo's main competitor in the food retail market of Ukraine (but in last years it was bankrupt).

The trade area of Silpo stores increased from 340,000 square meters at the end of 2017 to 484,000 square meters at the end of 2021.

Financial standing

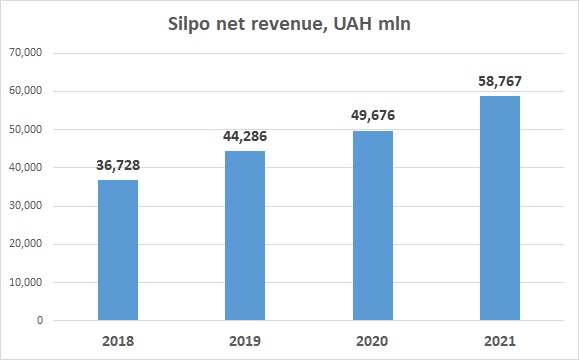

The dynamics of the company's turnover (since 2017, Silpo-Food LLC has been the operator of the network) is in line with the increase in trade area - from 2018 to 2021, the increase in trade area made about 35%, while the net revenue of Silpo-Food (from retail trading) - by 56%. During this period, sales per square meter increased by an average of 15-20%, due to rising prices (in real terms, excluding inflation, sales per square meter remained fairly stable).

In general, the company's financial standing at the end of 2021 can be defined as average.

The total revenue (without VAT) of Silpo-Food LLC in 2021 amounted to UAH 72.8 billion, of which UAH 58.8 billion was net income from retail trade (the rest is wholesale and export sales). Gross profit (the difference between revenue and the cost of goods sold) was UAH 20.6 billion, and gross margin made 28%, which was quite a high figure for food retail (maybe because Silpo operates in a fairly high price segment).

Despite the high gross margin, the company shows an operating loss, which in 2021 amounted to UAH -418 million. At the same time, the company's cost structure includes expenses related to the trademark and amortization of trademarks, without which the result would be significantly better (about UAH 1.5 billion). We estimate the company's EBITDA (operating profit before depreciation) in 2021 at a level of about UAH 3.5 billion.

Operating cash flow amounted to UAH 8 billion and was directed to the development of the network.

The company's balance sheet structure is quite typical for a food retailer. Stocks are fully financed by trade credit from suppliers, inventory turnover is about 45 days, which is close to the average value for Ukrainian food retailers. Equity is negative (-3 billion UAH), which is offset by debt to related companies (3.5 billion UAH).

As of December 31, 2021, the amount of bank loans on the balance sheet of Silpo-Food LLC amounted to UAH 3.8 billion, most of them were denominated in UAH, which is positive from the point of view of currency risks. In general, the company's debt burden is not very significant.

Impact of full-scale war

The russian full-scale invasion of Ukraine, which began in February 2022, had a significant negative impact on the network's activities.

In February and March, the company suspended the operation of 38 stores in the Kyiv, Kharkiv, Chernihiv, and Sumy regions, but as of the end of August, the operation of these stores was resumed. Also, 31 supermarkets were lost in the war zone and in the occupied territories, some of which were partially or completely destroyed. As a result of hostilities, one of the company's distribution centers in the Kyiv region was destroyed.

The company actively negotiated with trade premises owners to reduce the rental payments, and there was also a partial reduction in personnel costs.

Restructuring of payments on the company's loan portfolio was carried out.

As a result, Silpo managed not only to stabilize its operational activity but also to continue the process of opening new supermarkets. So, already in September-October 2022, new designer stores were opened in Uzhhorod and Rivne, and as of mid-October number of Silpo supermarkets reached the level of 300 again.

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer