16 March 2023

The biggest by market cap as of March 2023 Ukrainian public company published preliminary operating and financial results for Y2022.

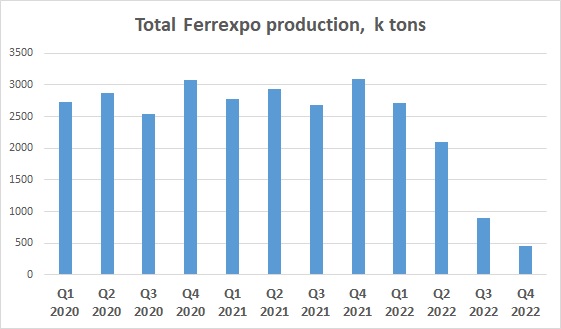

Total production volume decreased y-o-y by 46% to 6.1 mln tons. If in H1 decline y-o-y made just 14%, in the last quarter of Y2022 it comprised 85% - production activity was stopped due to electricity black-outs caused by russian missile attacks on Ukrainian energy infrastructure.

Out of four pellet lines only one worked in the end of Y2022 – beginning of Y2023, another one was re-launched in March 2023.

Ferrexpo iron ore pellets sales in H2 2022 made 1.8 mln tons (4.4 mln tons in H1).

83% of total sales volume was directed to European market (5.1 mln tons). Main logistics route was delivery by railcars, along with it pellets export by barges increased y-o-y by 0.4 mln tons up to 1.2 mln tons.

On our opinion continuation of grains corridor operation and gradual decrease of grains and oilseeds stocks in Ukraine should lead to decrease of Ukrainian grains and oilseeds export by railcars and barges, which, in its turn, should lead to improvement of situation with logistics for iron ore and steel producers.

As for average selling prices, in H2 2022 situation worsened as well. 65% Fe Iron ore price index (CFR China) decreased from an average value of $165/t in H1 2022 to $90/t in October 2022 (in the end of Y2022 index value bounced back to $131/t, which was positive for Ferrexpo).

Average 65% Fe Iron ore price index in Y2022 comprised $139/t (vs. $186/t in Y2021).

Atlantic pellet premiums have been stable high (on average at bout $72/t), which supported Ferrexpo profitability (Ferrexpo produces high-quality premium iron ore pellets).

Due to decrease of volumes and average sales prices total Ferrexpo revenues in Y2022 decreased by 50% y-o-y and made $1.2 bln.

On the other side costs increased. C1 cash cost of Ferrexpo in Y2022 made $83/t, which was by about 50% higher than in Y2021. Main reasons of increase – growth of energy sources (gas, electricity, fuels) prices and impact of production volumes decrease (effect of operating leverage - fixed costs per 1 ton are higher with decrease of production volumes).

Due to all mentioned negative factors, Ferrexpo EBITDA in Y2022 significantly decreased y-o-y and made $765M. Along with it, significant portion of reporting year EBITDA ($339M) resulted from UAH devaluation accounting effect. Disregarding this FX effect Ferrexpo EBITDA made $426M. In H2 EBITDA worsened vs. H1 and made (without FX effect) $20M.

Positive factor for the company – in Y2022 net operating cash flow of Ferrexpo made $301M. In H2 net operating cash flow was close to zero, which is considered by us as positive taking into account all the circumstances and production volume reduction.

Cash flows were partially ($161M) directed to investment activity – the company finished the project with high degree of readiness, then frozen its investment program except for maintenance. In addition during Y2022 $155M was paid as dividends to shareholders, while $42M made repayments of bank debt.

As a result cash balance as of Y2022 end made $113M with almost zero credit exposure. With total assets book value of $1.354 bln, $1.250M is financed by Equity – the structure and quality of Ferrexpo is good.

Taking into account that in the middle of March two out of for pellet lines of Ferrexpo were operating (capacity of each one – 250kmt of pellets output per month), in case Ukrainian Black Sea ports will remain closed for iron ore, but situation with electricity in Ukraine improves vs. Q4 2022 (which is the case as of mid-March), total Ferrexpo pellets output in Y2023 can be close to Y2022 figure (5-6 mln tons).

If global iron ore prices will stay close to current level, we expect that Ferrexpo activity will be profitable, which in its turn should further improve financial stability of the company.

Ferrexpo financial performance

2022

2021

Pellets production

6 053

11 220

Revenues, $ mln

1 248

2 518

EBITDA, $ mln

765

1 439

Net income, $ mln

220

871

Operating cash flow, $ mln

301

1 094

Cash, $ mln

113

167

Debt, $ mln

6

50