22 January 2023

Despite the difficulties with the production and export, due to the favorable situation on the market of seamless pipes and import duties removal in the EU and US, Interpipe demonstrated good financial performance in the reporting quarter.

From a production perspective, the biggest challenge for Interpipe in the third quarter of 2022 was the russian shellings of Nikopol in general, and Interpipe's Nico Tube facility, where the group produces seamless pipes, in particular.

At the same time, there was favorable situation on the seamless pipe market (especially in the OCTG segment - pipes used for oil and gas wells) - prices have increased, while the USA and the EU have canceled their import duties for Ukrainian products. Interpipe itself has been gradually building export supplies through new logistics routes.

So working with significant restrictions Interpipe maximized the production of the most marginal products, while the total production compared to previous quarters has not changed significantly.

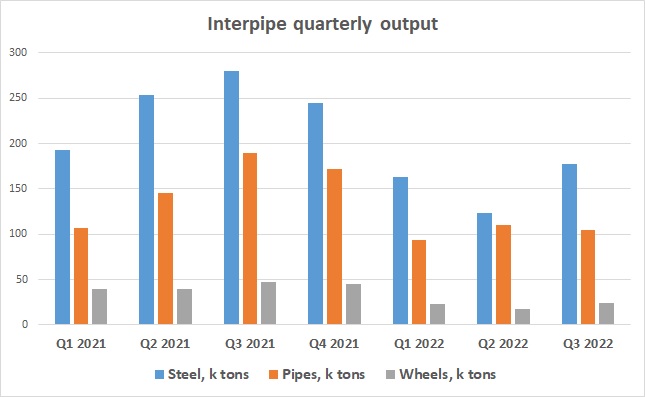

In the reporting quarter, Interpipe smelted 177,000 tons of steel (compared to 123,000 tons in the previous quarter), the production of pipes amounted to 105,000 tons (110,000 tons), wheel products - 24,000 tons (18,000 tons) . At the same time, it is important that the production of OCTG pipes increased by 57% compared to the previous quarter - from 33 thousand tons to 52 thousand tons.

Compared to the third quarter of 2021, production statistics remain disappointing - steel smelting decreased by 37%, pipe production - by 45%, wheels - by 49%.

The main figures of Interpipe's output during the last several quarters are presented in the following graph:

As for sales volumes, they halved y-o-y for all major types of products, while compared to the previous quarter, volumes are relatively stable. The only exception - in the segment of OCTG pipes in the reporting quarter, sales volumes increased by 23% compared to the previous quarter (due to the recovery of demand in Ukraine and high demand in the USA).

Due to the increase in the weighted average selling price of products, Interpipe's revenue in the third quarter of 2022 amounted to $226 million (compared to $222 million in the previous quarter and $279 million in the corresponding quarter of 2021).

In total, for the period January-September 2022, Interpipe's sales amounted to $687 million, which is only 10% lower than last year (in real terms, sales decreased by 36%, while the average price increased by 42%).

Taking into account the significant decrease in purchase prices for scrap metal in Ukraine (the average price in the reporting quarter was $169/t compared to $327/t a year ago), as well as the fact that in the Interpipe’s cost structure, scrap metal accounts for about 50%, production costs of Interpipe decreased, and profitability, on the other hand, increased significantly.

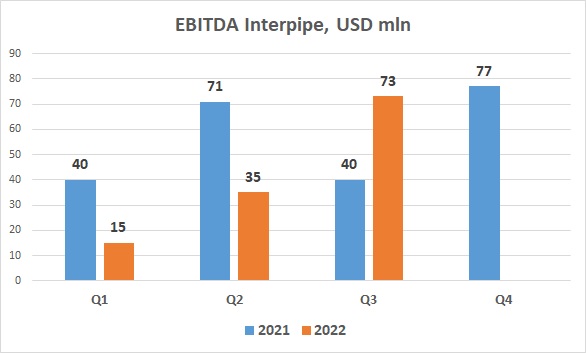

So Interpipe's EBITDA in the third quarter of 2022 reached $73 million (which is more than double the figure for the second quarter, and also more than in the third quarter of 2022, when EBITDA was $40 million).

The dynamics of the company's EBITDA during the last reporting periods was as follows:

In accordance with EBITDA, Interpipe's operating cash flow also increased - in the reporting quarter it amounted to $57 million. The funds were mainly used to repay the debt to the shareholder (Interpipe's owner is Victor Pinchuk), as well as the payment of $25 million in liabilities in frames of debt restructuring that took place a few years ago.

The company's investment activities are currently frozen.

As for further prospects and expectations from Interpipe, it can certainly be expected that the constant blackouts in Ukraine due to Russian missile strikes, starting from October, will have a significant impact on the company's activities (first of all, it concerns steel smelting). So we can expect a deterioration in operational and financial results already in the fourth quarter of 2022 and, at least, in the first months of 2023.

The balance sheet structure of the company after the restructuring signed in 2019 is more or less balanced - the total debt as of September 30, 2022 was $406 million, while repayment of the main part of the debt principal ($300 million) should take place only in 2026, so with the amount of cash on the balance sheet of $126 million, it can be assumed that the company has some room to survive difficult times.