26 September 2023

Metinvest improved its operating and financial performance compared to the second half of 2022.

On September 19, the Metinvest group published a press release and a presentation with the main indicators of the group's financial report for the first half of 2023.

h1 2022

h2 2022

h1 2023

Steel output, kmt

2412

506

1032

Iron ore output, kmt

8804

1908

4746

Coal output, kmt

2430

2529

3043

Revenue, $ mln

5272

3016

3554

EBITDA Total, $ mln

1558

315

487

EBITDA Metallurgy, $ mln

259

8

166

EBITDA Mining, $ mln

1299

248

358

Cash, $ mln

460

349

352

The total revenue of the group in the reported period made $3.554 billion, which is significantly lower vs. H1 2022 (-33%, but one must take into account the high base of comparison due to operations before the full-scale invasion in Jan-Feb 2023). Along with it, revenue was by 18% higher than it was in H2 2022 ($3.016 billion).

Vs. H2 2022the turnover increased in both segments - mining and metallurgical - even despite the decrease in the average sales prices of all main types of products, except for iron ore concentrate.

The reason for the increase in turnover is growth in the volume of sales in physical terms, which is, first of all, a consequence of the resumption of production at the Ukrainian enterprises of the group after the problems caused by energy blackouts in October-December 2022.

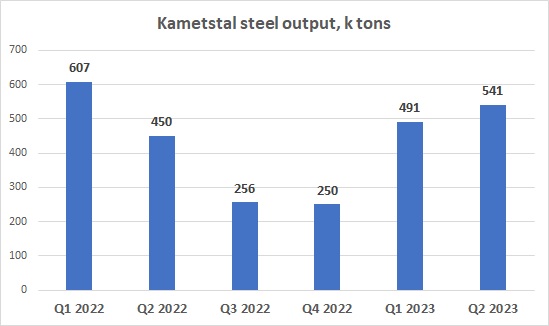

For example, the Kametstal steel mill, due to problems with energy supply after Russian missile attacks on Ukrainian energy infrastructure, stopped production in November, and just gradually began its recovery in December.

As a result, Kametstal increased steel production from 506,000 tons in the second half of 2022 to 1,032,000 tons in the first half of 2023. The dynamics of pig iron production was similar - currently, the plant operates two out of three blast furnaces, which allows to produce about 150-200 thousand tons of pig iron and steel per month.

In the mining segment, Metinvest increased the output of iron ore concentrate in comparison with the second half of 2022 by 2.5 times - from 1.9 million tons to more than 4.7 million tons. In the reporting period, all three GOKs of the group were operating - Northern, Central and Ingulets.

At the same time, the output of coal concentrate increased both in comparison with the previous half-year and the first half of 2022 (by 20% and 25%, respectively). The increase relates to both Metinvest's coal mines in the United States (United Coal) and the Pokrovske Coal located in the Donetsk region of Ukraine (the volume of output in the reporting period was more than 1.5 million tons of coal concentrate, +23% vs. H2 2022).

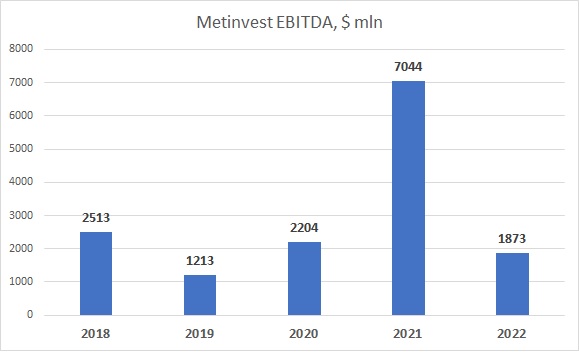

From the point of view of the group's profitability, in the first half of 2023 Metinvest's total EBITDA was $487 million ($315 million in H2 2022), both business segments were profitable (EBITDA of the mining division was $358 million, the metallurgical division - $166 million).

It is also important that in the reporting period the operating cash flow was positive and amounted to $313 million (the difference vs. EBITDA is mainly due to paid interest and income tax). The cash flow was directed to investment activities ($140 million, of which 85% was directed to maintenance) and debt repayment ($176 million). As a result, the amount of cash on the group's accounts as of the end of the first half of the year amounted to $352 million (almost unchanged compared to December 31, 2022).

At the moment, the company's total debt is relatively large ($1.9 billion), but its maturity structure is acceptable. During the second half of 2023 and in 2024, Metinvest has to repay only $66 million of debt, so liquidity position of the company is good.

The biggest Metinvest debt payments are to be made over the years 2025-2027, as well as after 2029.

So at the moment, the financial standing of Metinvest remains acceptable, the main risk for the company is price risk (a potential drop in prices for iron ore and steel, so that due to significant logistics costs during export, Metinvest may lose to global competitors), while a big advantage is still significant level of vertical integration , due to own mining of iron ore and coal.