8 April 2023

One of the leading Ukrainian beer producers in 2022 took advantage of the problems of its competitors and managed to improve financial performance despite full-scale war.

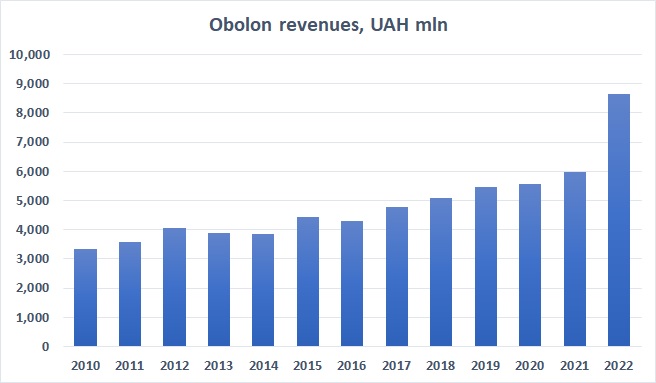

According to Opendatabot data, the total revenue of the Obolon company in 2022 increased by almost 50% compared to 2021 and amounted to UAH 8.7 billion.

In 2021, beer sales accounted for about 60% of the total revenue, for 2022 there is currently no such information, but, according to our estimates, this share has at least not decreased, that is, the revenue from the beer realization in 2022 has increased by at least the same 50%.

The main driver of such dynamics was price growth - according to the State Statistics Service, the price of beer in Ukraine rose by 48% in 2022.

But even despite the increase in prices, as well as the general reduction in production and consumption of beer in Ukraine (production in 2022 decreased by 28%, consumption, according to our estimates, by 25%), Obolon increased the volume of sales of beer in natural terms.

The reason for such dynamics is simple - the problems of competitors.

Due to the fact that AB InBev Efes group factories in Chernihiv, Mykolaiv and Kharkiv remained closed from the beginning of the full-scale invasion until December 2022, this company lost 70% of its sales. The largest plant of the group in Ukraine - in Chernihiv - was damaged during the shelling of the city by the Russian army in the spring, while the company began to partially resume production only in December.

As a result, the revenue of AB InBev Efes Ukraine in 2022 amounted to UAH 2.3 billion, 67% lower than in the previous year.

Another competitor, Carlsberg Ukraine (the leader among Ukrainian beer producers in 2021 with a share of more than 30%, the company's plants are located in Kyiv, Lviv and Zaporizhzhia), did better. This company even increased its turnover compared to 2021 by 8% (up to UAH 9 billion), but compared to the Obolon company, the growth is much more modest.

As for Obolon's other financial performance figures, we note that the company's EBITDA increased from UAH 347 million in 2021 to more than UAH 2 billion in 2022, resulting in a net profit of UAH 1.2 billion in the reporting year. From the point of view of financial results (as well as from the point of view of market share), this year can be called the most successful for Oboloni in the last 10-15 years.

As a result of good performance, the company significantly improved its balance sheet structure - the total loan portfolio halved - from UAH 1.6 billion at the end of 2021 to about UAH 800 million as of 12/31/22.

In 2023, the situation for the company will be more difficult - AB InBev Efes Ukraine is gradually resuming production and returning to the market, it will be difficult to compete with international players again, but, at least, today the Obolon Corporation has a much greater margin of safety in its activities compared to the past years.