19 November 2023

Despite some worsening of performance in July-September, Astarta's activities remain profitable, the financial standing is good.

Astarta, one of the largest Ukrainian producers of sugar and milk, as well as soybean crushers, has published its financial report for the thirsd quarter of 2023.

EUR mln

Q3 2023

Q2 2023

9m 2023

9m 2022

Sugar sales, kmt

83 69 203 163

Soybean crush, kmt

42 64 167 151

Milk output, kmt

27 29 86 75

Revenues

105 124 392 341

EBITDA Total

20 59 117 131

EBITDA Sugar

10 12 35 26

EBITDA Farming

1 33 45 81

EBITDA Soybeans crush

2 10 22 19

EBITDA Milk

8 4 17 7

Operating cash flow

10 24 79 3

Usually in the third quarter of the calendar year, Astarta harvests early grain and oilseed crops, and also makes preparations for the new season of sugar production and soybean processing.

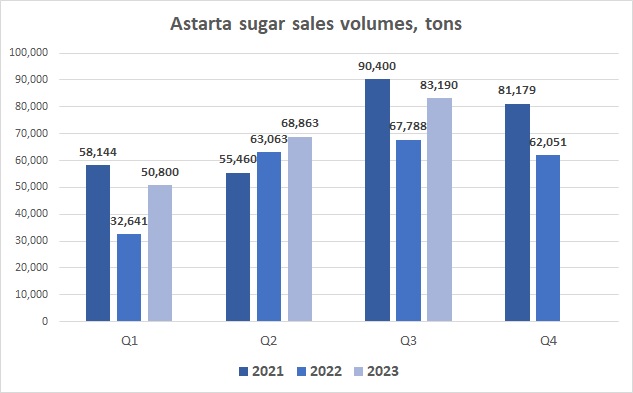

In addition, during the last years, in the third quarter, Astarta actively sells sugar, taking advantage of higher domestic prices for sugar at the end of the season compared to previous periods.

The current year was no exception - despite the ban on Ukrainian sugar export from June 5 to mid-September, in the third quarter of 2023, the volume of sugar sales by Astarta increased both q-o-q and y-o-y and amounted to 83 thousand tons.

As we expected, the profitability of sugar sales remains quite good - EBITDA per 1 ton of sugar, although decreased compared to the previous two quarters (due to a decrease in the average selling price), amounted to 125 euros per 1 ton (in the second quarter of 2023 - 179 euros for 1 ton).

The total EBITDA of the Sugar segment in the reporting quarter amounted to EUR 10.5 million, in the first nine months of 2023 EUR 34.6 million (a year ago EUR 25.6 million).

Taking into account the expected increase in sugar production by Astarta in the new season, the opening of Ukrainian sugar exports from the second half of September, as well as high global sugar prices, we can expect good segment's performance in the new season 2023/24.

In the segment of soybean processing in the reporting quarter the results worsened compared to the previous preriods. 2022/23 soybean processing season was already coming to an end, due to active export and processing, the stock of soybeans in the domestic market was significantly reduced, so the total volume of soybean processing by the company made 42 thousand tons compared to 64 thousand tons in the previous quarter.

The negative factor that affected the profitability of the segment was the decrease of soybean oil average sale price. In the reporting quarter, it was 769 euros per 1t, compared to 832 euros in the previous quarter and 1,004 euros in the first quarter of 2023.

As a result, the total EBITDA of the soy processing segnebt in the reporting quarter was 2 million euros compared to 10 million in the previous one. In total, in the first nine months of 2023, Astarta earned 22 million euros in the soybean processing segment.

In the Agriculture segment, two main points related to the company's operational activities seem to be the most important.

The first one is that, by the end of June'23, Astarta sold almost all the stock of the 2021 and 2022 harvest, so it enters the new season with small grains stock (which, in turn, has a positive effect on the company's liquidity).

The second point relates to the y-o-y changes in breakdown of sown area in the 2023/24 season: Astarta halved the area under corn (from 38,000 ha to 19,000 ha), the area under wheat also decreased (from 55,000 ha to 43,000 ha), the area under sugar beet (from 33,000 ha to 39,000 ha), soybean (from 40,000 ha to 57,000 ha) and rapeseed was significantly increased.

Changes in the structure of sown areas between different crops are related to Astarta's focus on its own processing and sales of products with greater added value, while reducing dependence on grain exports routes (for corn and wheat).

The yield of the main crops (except for corn and sugar beet, for which data are currently unavailable, as harvesting continues) in 2023 was a record or close to a record: wheat (updated data) 5.7 t/ha, soybeans 3.1 t/ha, sunflower 3.0 t/ha , rapeseed - 3.3 t/ha.

On the other hand, in the reporting quarter Astarta's sales of grains and oilseeds were relatively small (the segment's sales for the third quarter of 2023 were only 14 million compared to 100 million in the first half of the year).

Due to logistic difficulties and the drop in global prices, grain prices in Ukraine remain at a low level, so the revaluation of the harvested crop, as well as biological assets (crop in fields), which reflects the expected financial results from the sale of the crop, in the current period was significantly less than in previous years (39 million euros for 9 months of 2023, 69 million euros for the same period in 2022, 107 million euros in 2021).

As a result EBITDA of the segment for the reporting quarter was close to zero, for the first nine months of 2023 45 million euros (result was much better vs. other agriholdings such as MHP and IMC).

With a higher proportion of sugar beets, soybeans and rapeseeds in the company's crop rotation this year and high yields, we expect the Astarta segment to perform better than the industry average, but the new season promises to be challenging anyway.

In the Milk production segment, the formal results in the reporting quarter were quite good EBITDA was 7.5 million euros, but 6 million euros of it was the revaluation of biological assets, so the growth of profitability figures compared to previous periods should be treated with caution. For the nine months of 2023, EBITDA of the direction amounted to 17 million euros, of which 8 million euros is a revaluation.

Compared to 2022, sales of milk in physical terms increased by 12.5%, but the average selling price, on the contrary, decreased - from 371 euros per 1 ton to 335 euros.

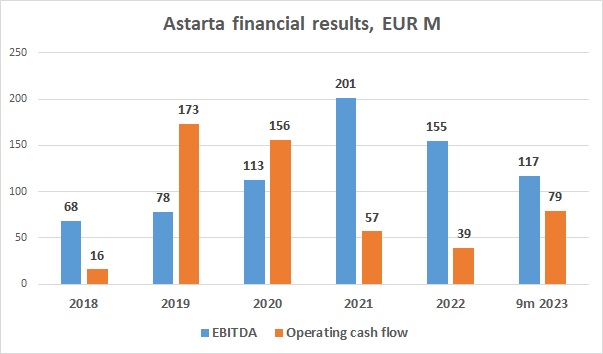

Astarta's total EBITDA in the third quarter of 2023 was approximately EUR 20 million (if we include lease payments - EUR 15 million), of which EUR 16 million is the revaluation of biological assets, so excluding the revaluation the result was close to zero.

For January-September, Astarta's EBITDA amounted to EUR 117 million (EBITDA adjusted on lease payments EUR 90 million), net profit EUR 56 million. Despite all the circumstances, Astarta remains profitable and shows good performance.

The company's operating cash flow for the first nine months of 2023 amounted to almost EUR 79 million (including interest payments on loans and lease payments - EUR 49 million). These funds were directed to investment activities (18 million euros, primarily maintenance program and capex to increase energy independence), debt repayment (18 million euros) and payment of dividends (12.1 million euros).

The company remains quite conservative in its development and focuses on the operational and financial stability of the business, especially in the current environment of a full-scale invasion. But we note that Astarta plans to start a project on the production of soy concentrate (which was announced back in 2021). The total amount of investment in the project should be about 50 million euros for the next 3 years.

In our view, the company can well afford new investments into new projects, as the quality of its balance sheet remains close to excellent.

Astarta's total debt (excluding lease obligations) is EUR 51 million with cash and cash equivalents of EUR 27 million and inventories with a book value of EUR 223 million (an additional EUR 92 million are current biological assets - mainly sugar beet and corn crops in field).

The company finances its activities mainly with its own funds, the book value of equity as of September 30 was EUR 539 million, the current (as of November 10) capitalization of the holding is $176 million.