30 March 2023

The biggest Ukrainian steel and iron ore producer reports financial results for Y2022.

Taking into account Metinvest's woes due to full-scale russian aggression - first of all, the loss of steel mills in Mariupol (in 2021 they produced 40% of all Ukrainian steel), the halt of production at the coke plant in Avdiivka (which was the largest coke plant in Europe), the blocking of Ukrainian Black Sea ports, as well as russian missile strikes on Ukrainian energy infrastructure in the last quarter of the year, the company's financial report was awaited with some anxiety.

An additional negative factor for the group was a decrease in global steel and iron ore prices, which began in March 2022 and continued till the last quarter of the year.

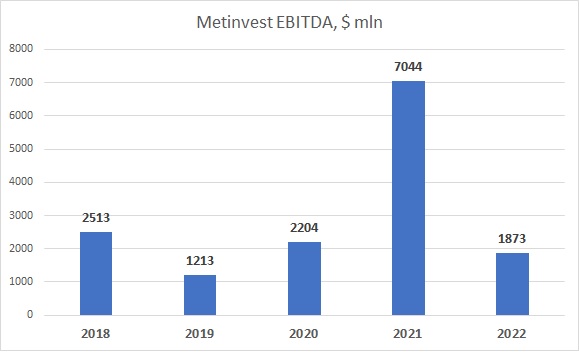

A positive factor was the fact that 2021 was one of the best years in the history of the group in terms of financial performance (Metinvest EBITDA amounted to $7 billion, net operating cash flow - $5.5 billion, while $2.5 billion was directed to pay dividends to shareholders - Rinat Akhmetov and Vadim Novinskyi), so at the beginning of 2022 the group had a good liquidity position, which helped to survive the most difficult times in its history.

The amount of cash in the company's balance sheet as of December 31, 2021 was about $1.2 billion with a total credit debt of $2.2 billion (the main part is Eurobonds with repayment in 2025-2029).

In the first half of 2022, Metinvest's revenue decreased by 38% to $5.3 billion compared to the same period in 2021. At the same time, EBITDA amounted to $1.6 billion, but due to the write-off of assets in the total amount of $2.2 billion, the group received a net loss in the amount of $1.7 billion. Cash as of as of 06/30/22 amounted to $460 million - the liquidity position has worsened.

In a view of all the difficulties, in the second half of the year the group's revenue continued its decline, amounting to $3 billion, but at the same time the EBITDA value was positive and amounted to about $315 million. Taking into account that the total capital expenditures in the reporting period (H2 2022) amounted to about $150 million, the company was able to generate cash flow to cover current operating costs and service its debt.

The amount of cash in the company's balance sheet as of 12/31/22 was about $350 million. Taking into account the improvement in the electricity supply in the first quarter of 2023, as well as a certain increase in world prices for ore and steel, starting from November 2022, it can be concluded that in the first half of 2023, the operating and financial results of the group should improve compared to the second half of 2022.

Given that in 2023 Metinvest has to repay $193 million in loans and bonds, we believe that the group will be able to service and repay its debt in line with existing schedules. At the same time, the margin of safety (in terms of cash) as of the end of 2022 was not significant, so in case of a significant deterioration of the situation in key global markets, it is possible that the group will need the support of shareholders.

The operational and financial results of the group are shown in the table below:

H1 2022

H2 2022

2022

2021

Steel output, kmt

2412

506

2918

9533

Iron ore output, kmt

8804

1908

10712

31341

Coking coal output, kmt

2430

2529

4959

5542

Revenue, $ mln

5272

3016

8288

18005

Total EBITDA, $ mln

1558

315

1873

7044

EBITDA Metallurgy, $ mln

259

8

267

3257

EBITDA Mining, $ mln

1299

248

1547

4214

Net profit, $ mln

-1698

-495

-2193

4765

Capex, $ mln

207

147

354

1280

Cash, $ mln

460

349

349

1166