14 April 2023

In terms of operational and financial results, the fourth quarter was quite good for Ukraine's largest chicken producer, given the problems with energy supply, as well as relatively low yields of late grain crops.

$M

Q4 2021

Q4 2022

Revenue

725

766

EBITDA

129

109

Net Operating Cash Flow

-133

8

In the fourth quarter of 2022, poultry sales in tons increased by 5% y-o-y and comprised 189,000 tons (export sales increased by 6% to 111,000 tons).

The average sale price of chicken in the reporting quarter, despite a significant decrease compared to peak prices in the summer, remained higher than the average sale price in the fourth quarter of 2021 ($1.87 per 1 kg versus $1.77 per 1 kg - export prices increased by 25%, while local prices in Ukraine in USD terms decreased by 24%).

An additional positive effect on the results of the poultry production segment was the 21% increase in sunflower oil exports compared to last year.

The total revenue of the segment in the fourth quarter of 2022 amounted to $537 million, which is 15% higher than last year. Segment EBITDA was $86 million compared to $57 million in the fourth quarter of 2021.

In the Crop Production segment, the main impact on the results was a significant decrease in the yield of corn compared to last year's figure - in the current season it made 7.2 t/ha vs. 10 t/ha in 2021 (in Y2022 corn yields were quite low in the Vinnytsia region, where a large part of MHP land bank is located), so the operational and financial performance of this business segment of MHP has deteriorated.

MHP's total adjusted EBITDA in the fourth quarter of 2022 was $109 million, compared to $129 million last year. The operating cash flow of the group in the reporting quarter was close to zero. In the same period last year it was negative, so current year's result is relatively good, the company keeps its "safety cushion" in the form of about $300 million cash in its accounts.

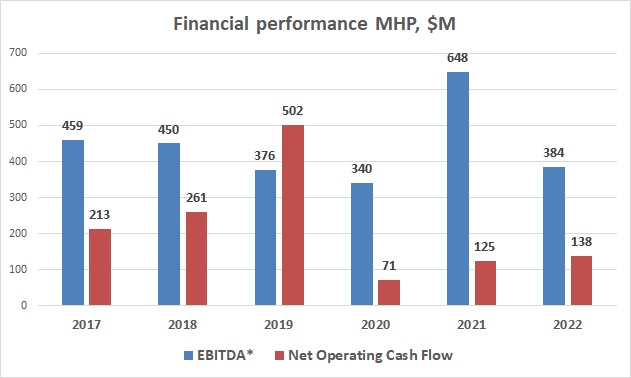

As for the operating and financial result of MHP for the entire year 2022, despite the full-scale invasion of the Russian Federation, the blocking of Ukrainian ports for the export of agricultural products for a large part of the year, massive strikes on the Ukrainian energy infrastructure in the last quarter of the year, it can be noted that the company coped with all the challenges perfectly.

$M

2021

2022

Poultry sales, k tons

704

666

Average poultry sales price, $/kg

1.67

1.95

Revenue

2 372

2 642

EBITDA

648

384

Net profit

393

-231

Net Operating Cash Flow

125

138

A significant positive factor was the above-mentioned increase in chicken prices on the main export markets.

As a result, export prices increased by 40%, and the overall average sale price of chicken - by 17% (from $1.67 per 1 kg in 2021 to $1.95 per 1 kg). So, despite the decrease in the volume of poultry meat sales in tons by 5% (and also taking into account the increase in the volume of sunflower oil sales compared to last year by 32%), the total revenue of the company's poultry production segment increased in 2022 by 17% and amounted to $1,887 billion The EBITDA of the segment was almost unchanged compared to last year and amounted to $270 million.

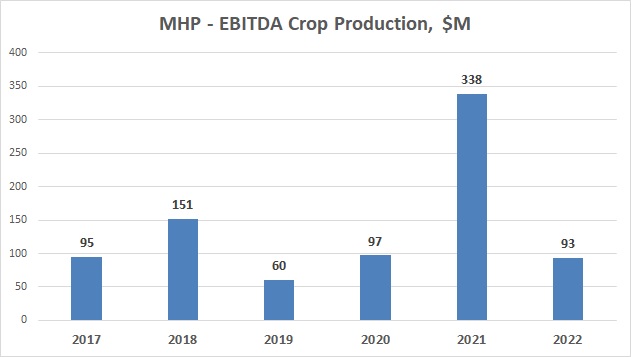

On the other hand, in the Crop Production segment, performance figures were much more modest, especially if compared with last year. Lower corn yields, rising costs, and logistical issues with grain exports in 2022 led to a decline in adjusted EBITDA from $338 million to $93 million. It is also worth noting that the segment's profitability in 2021 was an absolute record-high - that year was truly unique for the Ukrainian agricultural sector due to the fact that the high yield of the main crops coincided with the period of high global prices for grains and oilseeds (on the other hand, a large part of the 2021 harvest remained unexported until almost the end of 2022 due to the blockade of Ukrainian ports, so part of producers’ profits remained unrealized).

If we compare the result of the Crop Production segment of the MHP in the reporting year with the results of two or three years ago, the results of 2022 also look decent:

The results of the European division of the MHP were also quite good. The Slovenian Perutnina Ptuj increased realization volumes by 7% compared to last year, revenues grew by 16%, while EBITDA remained almost unchanged at $63 million.

So the overall results of MHP for 2022 are as follows: revenue in the amount of $2.6 billion (+11% y-o-y), adjusted EBITDA - $384 million. Part of operating profits were used for the debt servicing (interest payments on loans and bonds amounted to $125 million), net operating cash flow of MHP for the year amounted to $138 million (last year - $125 million).

It should be noted that in 2022 MHP allocated $174 million for investment activities. Moreover, the company plans to invest almost the same amount of funds in 2023 as well. During a conference call with investors, the company noted that $70 million will be directed to maintenance investments, another $40 million will be used to develop MHP as a culinary company, and $50-60 million will be used for other projects (including further development of Perutnina Ptuj operations).

We see such investment plans as quite aggressive, especially taking into account the existing risks associated with a full-scale Russian invasion of Ukraine (on the other hand, part of the investment - namely investment in logistics - eliminates part of these risks).

The company has decided not to pay dividends to its shareholders based on the results of 2022. The structure of the MHP balance sheet in 2022 did not undergo significant changes. The debt burden of the MHP, as always, remains significant. The company's total debt as of the end of the year amounted to about $1.6 billion.

Most of the debt is $1.4 billion in Eurobonds (three issues with maturities in 2024, 2026 and 2029).

The biggest risk for the company and its creditors is the repayment of $500 million in bonds in 2024. On the one hand, the total amount of cash on the company's balance sheet is about $300 million, and in 2023, all business segments are expected to be profitable.

On the other hand, in the current conditions, in order to ensure the normal operation of the company, it is necessary that the amount of funds in its accounts is not less than $200-250 million. The plans of MHP for 2023 include a fairly significant amount of investments that will require financing. Also, at the moment, there are general restrictions for Ukrainian companies from the National Bank of Ukraine regarding the purchase of foreign currency to repay liabilities.

During a conference call with investors, the CFO of MHP Viktoriya Kapelyusna did not directly answer questions about the company's plans to repay the bonds, noting that this issue is currently one of the group's priorities.

On the other hand, in our opinion, taking into account all the circumstances and risks, we consider the future request of the group to its creditors to restructure the obligations from the bonds maturing in 2024 as quite likely.

From the point of view of overall operating activity, in our opinion, MHP's prospects for 2023 are relatively good. In 2022, the company proved that even under the conditions of blocked Ukrainian ports, it is able to ensure the export of poultry meat and sunflower oil through alternative logistics routes.