8 April 2023

In 2022 revenues of Nibulon decreased to UAH 15.2 billion, while the company's net loss amounted to UAH 10 billion.

Nibulon suffered the most among grain trading and exporting companies as a result of full-scale Russian aggression. In addition to the death of the founder and owner of the company Oleksiy Vadaturskyi, the entire business model of the company was destroyed immediately after invasion.

The main reason is the stoppage of shipping on the Dnipro river and the blockade of Mykolaiv port. At the same time, if other large exporters that worked in Mykolaiv - such companies as Cofco and Bunge - have a large margin of safety due to the fact that they belong to large international groups, the situation with Nibulon is different.

The main problem is a large debt burden. According to the official reporting data of Nibulon (a Ukrainian legal entity) for 2021, its loan portfolio amounted to UAH 12.3 billion (about $450 million at the exchange rate as of 12/31/21), and it was fully nominated in USD.

The amount of inventories at fair value as of the end of 2021 was about UAH 9 billion. The value of grain depends on the forex exchange rate (in increases in UAH with hryvna devaluation), but the value in USD terms decreased significantly in 2022 due to the blockade of Ukrainian ports.

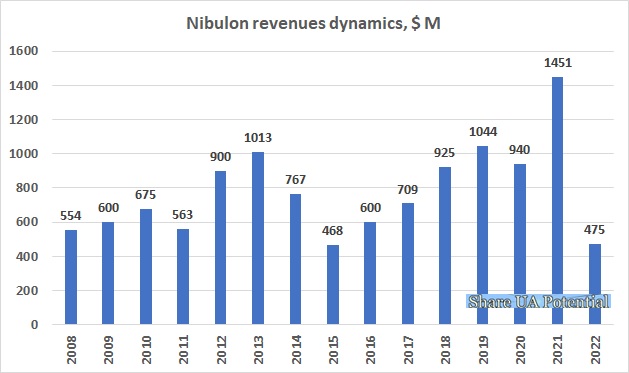

In 2022, the total export of grains by Nibulon amounted to 1.8 million tons, which is 68% less than in the previous year. In line with it, Nibulon revenue in the reporting year (according to Opendatabot data) decreased by 63% and amounted to UAH 15.2 billion (in dollar terms, the decrease was even bigger).

At the same time, in 2022/23 season more than half of Nibulon's exports take place through the Danube ports, where, according to our estimates, the profitability of exports is lower compared to the profitability of exports through the Black Sea ports within the grain corridor.

Partially due to UAH devaluation the profitability of Nibulon operations increased - the gross profit in 2022 amounted to UAH 1.1 billion (compared to UAH 1.5 billion in 2021 year with a much smaller volume of exports). Per ton of exported products, the margin was approximately UAH 600 per 1 ton.

On the other hand, in 2022, Nibulon wrote off fixed assets in amount of UAH 2 billion, there was partial impairment of stocks, and due to the hryvna devaluation, the loss related to loans portfolio revaluation amounted to about UAH 4 billion.

So the amount of Nibulon's net loss in 2022, including all write-offs and impairments, made about UAH 10 billion. The operating cash of the company amounted to 1.5 billion and was directed partially to repayment of interest on loans, partially to investment activities (about UAH 500 million, according to our estimates, this is largely related to the construction of the river terminal in Izmail).

There were no significant loan repayments in 2022, so as of the end of the year, the total amount of Nibulon's loan portfolio amounted to about UAH 16 billion. At the same time, the balance sheet value of goods as of December 31, 2022 was UAH 5.5 billion.

Of course, the question remains whether the book value fully reflects the real value of the grains inventory, but even if we assume that the real value is higher than the book value by 50%, it turns out that the loan portfolio is a covered with inventory by no more than 60%.

So taking into account that during the first quarter of 2023 there were no significant changes in operational activity (the company exports about 150-200k tons of grains per month, most of it through the Izmail river terminal), it can be concluded that the overall situation for Nibulon remains very difficult, the company and its creditors can only hope for the earliest possible restoration of navigation on the Dnipro, as well as the unblocking of Mykolaiv port.