4 May 2023

Despite reduction in output volume, one of the largest Ukrainian producers of chicken eggs significantly improved its financial performance in 2022.

Ovostar published its financial report for 2022.

In line with our expectations, due to a significant increase in domestic prices for eggs in Ukraine, as well as fairly active exports (primarily to EU countries), the fourth quarter of 2022 became one of the most successful for the company in recent years.

Q4 2021

Q4 2022

Eggs output, mln

437 356

Shell eggs sales, mln

306 258

Revenues, $M

39 43

EBITDA, $M

0.3 4.7

Operating cash flow, $M

4.9 8.7

Adjusted operating cash flow, $M

0.1 5.4

During the reporting quarter, the group's total flock increased compared to previous quarters (to 7.2 million), but was 13% lower than last year figure (Ovostar is still in the process of restoring the flock after its significant reduction in the first half of 2022).

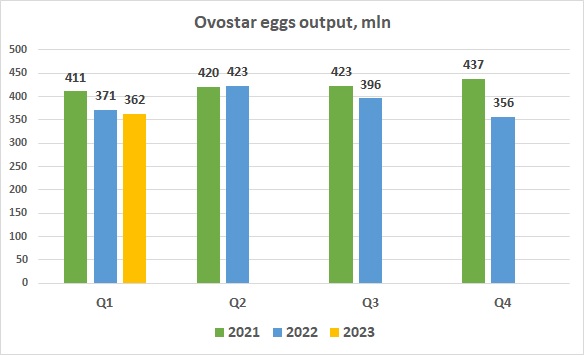

Egg production volume in the fourth quarter of 2022 amounted to 356 million eggs (-10% compared to the previous quarter and -19% compared to the fourth quarter of 2021).

The total sales of shell eggs in the reporting quarter were 16% lower than last year and amounted to 258 million pieces, the volume of processing dropped by 30%.

Despite the worsening of operating performance, due to the increase in the sales price, as well as a fairly low cost (due to relatively low domestic prices for grains and oilseeds), Ovostar's financial performance have significantly improved.

Revenue from sales in the fourth quarter of 2022 amounted to $45 million (+16% compared to the same period of the previous year), EBITDA - $4.7 million, despite a decrease in the estimated value of biological assets by $17.6 million.

The group's operating cash flow during the reporting quarter amounted to $8.7 million, which led to the decision of the company's Board of Directors in December 2022 to pay an interim dividend to its shareholders in the amount of EUR 3.9 million. This is the first dividend paid by Ovostar for the last three years (the last dividend was paid basing on Y2018 results).

Operational and financial performance analysis for the whole 2022.

2021

2022

Eggs output, mln

1 691 1 546

Shell eggs sales, mln

1 150 1 081

Shell eggs export, mln

264 290

Eggs processing, mln

501 427

Revenues, $M

133 135

EBITDA, $M

5.7 11.1

Operating cash flow, $M

18.2 19.5

Adjusted operating cash flow, $M

-0.4 10.7

In total, in 2022, Ovostar produced 1,546 million eggs, 8.5% less than in 2021. Sales of shell eggs amounted to 1,081 million pieces (-6% compared to the previous year), processing volumes – 427 million pieces (-15%).

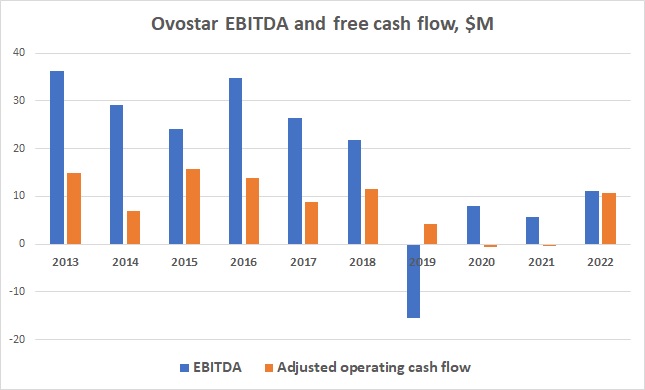

The company's revenue in the reporting year amounted to $135.6 million – slightly higher vs. the previous year. Profitability increased - the company's EBITDA, despite the negative revaluation of biological assets in the amount of $26.3 million, increased from $5.7 million in 2021 to $11.1 million.

Operating cash flow for 2022 amounted to $19.7 million, which was almost unchanged from the formal $18.2 million in 2021, but operating flow adjusted for investments into biological assets (increase/renewal of flock) increased significantly from close to zero in 2021 year to $10.7 million in 2022.

We consider the last indicator to be one of the most important for understanding the real situation in business. In 2020 and 2021, adjusted operating cash flow was close to zero, which is a clear evidence of a significant improvement in financial results in 2022 (even taking into account the decrease in the total flock in the reporting year).

If we take into account the fact that Ovostar has always been very conservative from the point of view of loans taking (as of the end of 2022, the total amount of loans in the company's balance sheet amounted to $11 million, with the amount of cash - before the payment of interim dividends - in the amount of $12.1 million), financial standing of the company at the end of the reporting period remains good.

Taking into account the favorable situation on the domestic egg market of Ukraine during January-April 2023 (prices began to gradually decrease only starting from the second half of April), we expect good financial results in Q1 2023.