TAS Group is one of the largest financial and industrial groups of Ukraine with assets in the agricultural sector, machine-building, banking and others.

The main owner of the group is a well-known Ukrainian businessman and politician Serhii Tigipko, the group is named after his daughter - Anna Sergiyivna Tigipko.

History of the TAS Group

After graduating from a higher educational institution and serving in the army, Tigipko took an active part in Komsomol activities, and in 1989 became the first secretary of the Dnipropetrovsk Regional Committee of the Komsomol.

In 1991, Tigipko became the deputy chairman of the board of the commercial bank Dnipro, and the following year - the chairman of the board of Privatbank (by the way, it was Serhiy Tigipko who had the idea of creating Privatbank).

In 1997, Serhii left Privatbank, and after some time his stake in the bank was bought out by other shareholders. Later, Tigipko headed the National Bank of Ukraine for some time, actively developed his political career (the peak of which was achieved 2010, when he won more than 13% in the first round of the presidential elections), and also gradually developed his own business empire.

Using his experience at Privatbank, Tigipko developed a new project in the banking sector - TAS-Komersbank - which in 2007, actually at the peak of the market, was sold to the Swedbank for $735 million.

During 2005-2007, there were quite a few successful sales of Ukrainian local banks to foreign investors, but in our opinion, the sale of TAS-Komersbank, as well as Leonid Chernovetsky's sale of Pravex Bank to the Italian group Intesa Sanpaolo, became the most successful for sellers.

With the sale of the bank, Serhii Tigipko received a financial resource that he could use for business development and the purchase of assets that had significantly decreased in price as a result of the financial crisis of 2008-09. Below we describe main business segments of TAS Group.

Banking - monobank and others

After the sale of TAS-Komersbank to the Swedbank, Tigipko remained the chairman of the board of the bank for some time, and left this position only in June 2009.

For Swedbank, the investment in Ukraine was as unsuccessful as the sale of the bank was successful for Tigipko.

Reports that the Swedish group would like to exit the Ukrainian market started to appear as early as 2010, but the exit was finally formalized only in 2013.

The bank was sold to notorious Ukrainian businessman Mykola Lagun (who at that time already owned Delta Bank, Kreditprombank and was the main buyer of banks in Ukraine; this story also ended badly for him - after the 2014-15 crisis, the Laguna banking group went bankrupt).

After the sale of the main part of the banking assets to the Swedbank, the TAS group retained the Business Standard bank, which in 2011 was renamed to Taskombank (it is interesting that according to the terms of TAS-Komersbank sale to Swedes, Tigipko was obliged to sell the Business Standard as well, but in the end it did not happened due to the lack of buyers as a result of the financial crisis in Ys2008-09).

The development of Taskombank, as well as the banking business of the TAS group in general, took place rather slowly, until after 2014 the group started active M&A campaign.

VS Bank was acquired from the Russian Sberbank (until 2013 VS Bank was called Volksbank). According to data from the National Bank of Ukraine, as of July 1, 2017, in terms of total assets, ViS Bank ranked 28th among 88 banks operating in the country (at the same time, Taskombank was 25th).

In 2018, Taskombank and VS Bank were merged, so that the combined bank already ranked 17th among the largest Ukrainian banks.

Another investment - in 2016 Universal Bank was bought from in the Greek group Eurobank Ergasias S.A.. It was under the umbrella of this bank that Tigipko, together with former top managers of Privatbank, developed the most successful banking project in Ukraine in recent years - monobank.

Neobank mono and classic Taskombank, which focuses on corporate lending, perfectly complement each other.

Unlike most banks of Ukrainian oligarchs until 2014, Tigipko’s banks almost did not lend to companies belonging to the owner's business group. But some assets of those debtors of Taskombank who could not fulfill their obligations to the bank (for example, in the agricultural sector) found their place in the structure of the TAS group.

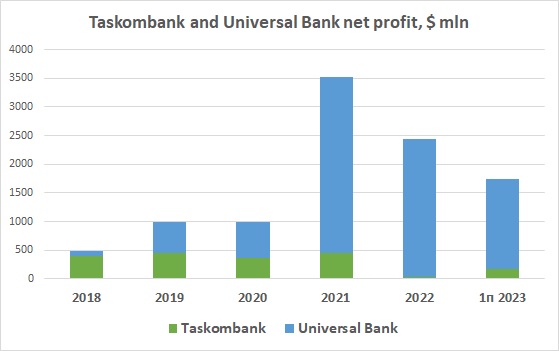

The dynamics of the net profit of Taskombank and Universal Bank in recent years is shown in the following graph:

It should be noted that Universal Bank (primarily due to monobank activity), received a profit of UAH 3.1 billion in 2021, UAH 2.4 billion in 2022 (the bank entered the top five most profitable in Ukraine), and UAH 1.6 billion in the first half of 2023.

The size of Universal Bank's assets as of June 30, 2023 was UAH 92.7 billion, Taskombank - UAH 33.7 billion. The share of the group in the Ukrainian market in terms of assets is about 5%.

According to Forbes, Serhii Tigipko's share in monobank is 50%, the share of the former top-management of Privatbank (the Dubilet family, Oleg Horohovskyi, Volodymyr Yatsenko and others, united in the IT company Fintech Band) is 50%.

Income between TAS and Fintech Band is redistributed by the payments for IT services from Universal Bank to Fintech Band. So the profit of Universal Bank reflects exactly the part of the TAS group in the total profit of the mono project.

In other segments of the financial market of Ukraine, the TAS group is also among the leaders.

In 2017, the leasing company ULF-Finance was created, which in 2020 occupied more than 20% of the market in the transport segment of leasing (second only to OTP Leasing). In 2021, the company earned UAH 67 million in net profit, in 2022 – UAH 26 million.

Tigipko companies are among the leaders of the insurance market of Ukraine. Two companies - TAS Insurance Group and TAS Insurance Company - in recent years collected insurance premiums from 2.5 to 3 billion UAH (per year), the net profit of these companies in 2022 was 367 million UAH.

The group also includes non-banking cash lenders (Credit Market and MyCredit), and a bad debt collection company.

As of the end of 2023, performance of the companies of the group, which operated in financial sector, despite the war, looked quite good, so we can expect their further development and an increase in their market share. According to our estimates, the total net profit of the financial segment of TAS group was UAH 3.7 billion in 2021, and UAH 2.7 billion in 2022 (the lion's share is monobank profit).

Before the war, occasional rumors had it about the potential sale of the monobank business, valuations of $1 billion were mentioned, and the owners (at that time) of Alfa Bank - Mikhail Fridman and partners - appeared in the mass-media as potential buyers.

After the beginning of the Russian invasion, Ukrainian assets lost a lot in value, so selling the bank before the end of the war is hardly possible.

Tas Agro

The first assets in Ukrainian agriculture Serhiy Tigipko obtained in 2008, when the TAS group together with the Swedish company Kinnevik created the RoAgro company with a land bank of 14 thousand hectares. In 2010, RoAgro's land bank was increased to 25,000 hectares.

In 2011, the Swedes left the group's agribusiness, and TAS Agro began actively expanding and increasing the land bank, which in 2013 reached the mark of 80,000 hectares (mainly in Kyiv, Vinnytsia, and Chernihiv regions).

In 2020, the process of clustering the company was completed. Four clusters have been created - TAS Agro Zahid, TAS Agro Center, TAS Agro North and TAS Agro South, each of which covers about 20,000 hectares.

In addition to the land bank itself, TAS Agro has seven silos with a total storage capacity of 350,000 tons. The main crops in TAS Agro's crop rotation have always been corn, wheat, sunflower, and soybeans, and in 2020-2021, the company significantly increased the acreage under corn (at the expense of soybeans and wheat):

Area, ha

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

Corn

24100 14700 42000 36000 22500

Sunflower

15900 31000 15000 14000 15200

Wheat

16500 12600 11400 17000 20000

Soybeans

11500 12700 3500 5500 15800

The yield of corn in TAS Agro has always been higher compared to the Ukrainian average, so in 2021 it was 10.5 t/ha.

In general, due to the increase in sown area and yield, in 2021 the company received a record corn harvest - almost 450,000 tons. Before the full-scale Russian invasion, TAS Agro managed to export about half of the record harvest, so at the time of the invasion, the company's ñùêò stocks amounted to more than 200,000 tons of grain.

After the beginning of the invasion, starting in May 2022, TAS Agro began to export grain through new logistics routes, and after the opening of the grain corridor from Ukrainian deep sea ports, the company started own grains transshipment operations though the deep sea port terminals and began to sell grain on an FOB basis.

It should be noted that in 2022, part of the land bank of the southern cluster of the group with an area of approximately 3.6 thousand hectares was under occupation.

With the full-scale war changes in the structure of planted areas took place - like many other companies, in 2022 TAS Agro significantly reduced the area planted with corn (from 42 thousand hectares in 2021 to only 14.7 thousand tons), increasing the share of sunflowers and soybeans. In this way, the company reduced the usage of fertilizers, as well as the dependence on product storage capacities (due to the reduction of the total volume of grain harvest).

Corn yield in 2022 decreased to 8.1 t/ha, wheat yield was 4.9 t/ha.

In order to export products with a higher added value, TAS Agro signed the tolling agreement with the ViOil company regarding the oilseeds crush at the plant of ViOil. At the same time, TAS Agro began to export the produced oil and meal.

In 2023, from the point of view of crop rotation, the group began to increase again the share of corn, the area of which made 24 thousand hectares, at the account of reduction of sunflower seeds area. Therefore, in the current year, the structure of TAS Agro's sown areas is close to what it was in 2018-2019.

The financial position of the agricultural division of the TAS group is stable, in 2021 the total net profit of the TAS Agro company and the four companies representing the clusters, according to the official financial statements, was approximately UAH 1 billion, in 2022 - almost UAH 500 million (the profit in 2022 was obtained from sales of the record harvest of 2021, it included, among other things, currency revaluation due to the devaluation of the hryvnia in the summer of 2022).

The main source of financing for the agricultural segment of the TAS group today is its own capital, bank loans as of the end of 2022 amounted to about UAH 1 billion (less than $30 million equivalent), which is not a very large amount, considering the size of the land bank and other assets of TAS Agro.

Periodically we see in Ukrainian mass-media the news that TAS Agro plans to expand its business and increase the company's land bank to at least 100,000 hectares.

Machine-building segment

The main asset of the TAS group in machine building is railcars producer (one of two biggest in Ukraine) Dniprovagonmash, which was acquired by the group back in 2004.

Also as separate legal entity In the structure of the group, there is a unit that produces casting products - the Dniprodzerzhynsk Steel Plant, and during 2020-2022, TAS bought the Poltavahimmash plant, which previously belonged to the bankrupt Azovmash group and produced railway tank cars.

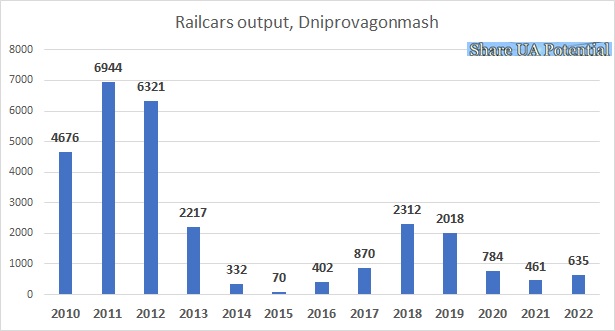

Until 2013, almost all wagon-building plants in Ukraine were focused on the Russian market. The Dniprovagonmash plant was no exception. So during 2011-12, the enterprise produced more than 6,000 wagons per year, 80-90% of which were delivered to Russia.

At that time, Dniprovagonmash was a real "cash cow" for the entire TAS group. During 2010-2012, the total net profit of DVM was about UAH 3 billion ($375 million), the company actively paid dividends to shareholders.

In 2013, the situation began to change - Russia banned the import of Ukrainian wagons. As a result, in 2014 the total production of DVM wagons decreased to 332, in 2015 - to a record low level of 70 wagons.

The company's financial performance largely worsened as well. In 2015, the company's turnover amounted to only UAH 61 million, while the company received a net loss in the amount of UAH 74 million. From the point of view of financial results, the situation could have been worse, but in 2014-15 the company succeeded in significant optimization and reduction of personnel – its labor costs decreased from UAH 240 million in 2012 to UAH 70 million in 2015.

In subsequent years, the situation on the railcars building market of Ukraine somewhat stabilized, but in general, the production figures of Dniprvagonmash remained very far from those of 2010-12. On average, during 2016-2022, the enterprise produced about 1,000 wagons per year, the highest number – 2,312 wagons was produced in 2018.

In 2022, Dniprovagonmash produced 635 wagons, which is more than in the two previous years, the company's turnover amounted to UAH 1.1 billion, and the net profit was UAH 48 million (the two previous years were unprofitable).

Currently, the TAS group in general and Serhiy Tigipko personally are working on the development of the export of Dniprovagonmash production to the European market. In frames of this strategy TAS acquired 40% of the shares of the Austrian company TransAnt, which produces freight cars. Other partners of the project are the Austrian metallurgical group Voestalpine, as well as the Austrian state railway transportation company OBB Rail Cargo Group. It is planned that Dniprovagonmash will supply a part of components for TransAnt.

It should also be noted that an important buyer of wagons produced by the enterprise over the past few years is related company TAS-Logistics.

TAS-Logistics

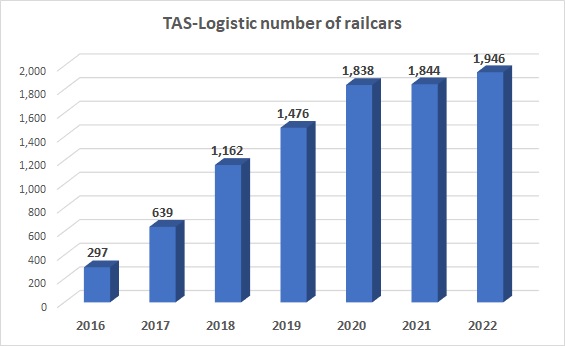

As of autumn 2023, the TAS group is one of the largest owners of railcar fleets in Ukraine. This direction is, on the one hand, a buyer of the railcars produced by Dniprovagonmash, and on the other hand, the company provides logistics services to TAS Agro, which can be a great advantage when exporting agri commodities in periods of shortage of logistics capacities in the country.

By the end of 2022, the company's fleet of wagons consisted of 1,946 railway wagons (of which almost 1,700 wagons are owned). These were mainly grain wagons, as well as 160 semi-wagons, more than 100 platforms and 10 tanks.

According to the estimates of the company's management, the share of TAS among railcar operators, taking into account the largest - the state-owned Ukrzaliznytsia - is approximately 5-6%.

As a result of the Russian full-scale invasion in February 2022, TAS-Logistic lost access to 59 wagons. On the other hand, in the fall of 2022, after the opening of the grain corridor from Ukrainian deep-sea ports, the lease rate of railcars and the cost and the services of grain freight forwarders increased significantly, so the financial results of TAS-Logistics in 2022 largely improved compared to previous years.

According to the company's official financial statements, EBITDA of TAS-Logistics amounted to UAH 918 million in 2022 (compared to UAH 233 million in 2021), net profit was UAH 386 million.

The financial standing of the company is acceptable, the main sources of financing are reinvested profits, as well as financial leasing (in open sources there is a lot of information about the leasing programs with which the OTP

Leasing company finances the purchase of TAS-Logistic wagons, mainly produced by Dniprovagonmash).

As of the end of 2022, the leasing obligations of TAS-Logistic amounted to approximately UAH 500 million.

Other assets of the TAS group

At different times, Serhiy Tigipko's group owned a large number of various assets. The businessman himself claims that if a high price is offered, he is ready to sell any of his businesses.

On the other hand, at times when assets are relatively cheap, a businessman tries to invest and buy new businesses. The story of the Dniprometiz plant is interesting, which the TAS group initially sold in 2005 to the Russian group Severstal for $46 million, and in 2017 bought it back from the same group for about $10 million.

At one time, TAS actively developed the retail pharmacy business and was one of the leaders of the Ukrainian market in terms of the number of pharmacy stores. As of the middle of 2021, there were 114 pharmacies in the network, in the same year the pharmacy business was sold to the Medservice company of the Dnipro businessman Oleg Tokarev.

TAS is an active player in the real estate market. As of autumn 2023, the group owns the Kyiv shopping and office center Arena City (with a total area of 14,000 square meters, included in the Arena complex together with Arena Entertainment, Arena Class and Mandarin Plaza), Radisson Blu Hotel Kyiv, Podil Mall and other objects.

In 2018, Serhii Tigipko bought the Kuznya na Rybalsky plant from the companies owned by Petro Poroshenko and Igor Kononenko for $300 million. The main assets of the plant were land plots in Rybalsky Ostarov, as well as near the Central Railway Station in Kyiv.

It was planned that the Lipki Island City Report residential area will be built on these plots of land - 36 buildings with more than 6,000 apartments. Construction never started, and at the end of 2022, Tigipko sold the asset to Ihor Mazepa's Concorde Capital company.

Serhiy Tigipko's group is presented in other directions - such as the Stolichny asphalt plant, quarries, a plant for the production of juices and concentrates, and the production of packaging on the facilities of the actually bankrupt Ukrplastik company.

TAS Group financials

The consolidated financial statements of the TAS group are not publicly available; accordingly, conclusions regarding the profitability of the group's activity, as well as its financial standing, can only be made based on the stand-alone financials of legal entities belonging to the group.

In one of the interviews with NV, Tigipko noted that the profit of the entire group in 2018 amounted to UAH 2.8 billion.

According to our estimates, the situation with profitability has improved since then - primarily due to the financial, agricultural and logistics segments. In 2021, according to our estimates, these three segments brought TAS 4.7 billion UAH in net profit (according to the financial statements of the Ukrainian companies of the group belonging to these segments), in 2022 - about 3.7 billion UAH.

The group's other business segments have been less profitable, but despite this, overall the group is doing well, even during a full-scale war.

The debt burden of TAS group companies is not very large, so even without having access to consolidated information, we can conclude that the overall financial position of the group is quite acceptable.

In 2024, Serhiy Tigipko is ready to invest $30-40 million in business development.