4 May 2023

In 2022, Astarta demonstrated good financial results in most operating segments - especially soybean processing and sugar production.

In the last quarter of the year, Astarta actively sold sugar, soy products, milk, wheat, and started selling corn of the 2022 harvest (the main part of the corn was sold in the first quarter of 2023).

The group's total revenue in the reporting quarter amounted to EUR 169 million, EUR 21 million less than in the fourth quarter of 2021 (due to lower sales of sugar and corn). EBITDA for the quarter was EUR 24 million, primarily owning to the sugar division and soybean processing business segments results.

Due to the peculiarities of the accounting in grains growing segment (the main part of the profit related to the harvest is reflected in the financial statements even before it is harvested - as profit from the revaluation of biological assets), in the reporting period the financial result of this direction was close to zero.

On a positive side, despite a busy sugar production season (with necessity in additional working capital) and logistic difficulties with grain exports (lower corn sales in Q4 vs. previous years), Astarta generated positive operating cash flow of EUR 36 million in the fourth quarter of 2022 (for comparison - in the first nine months of 2022 with EBITDA at the level of EUR 131 million, the operating cash flow of the company was close to zero).

So if during the first half of Y2022 Astarta actively attracted credit funds to create a liquidity cushion (during the first nine months of the year, the credit portfolio in general increased by EUR 77 million to EUR 107 million, with the amount of cash on the balance sheet at the end of September EUR 48 million), in the last quarter of the year, Astarta reduced credit debt by EUR 47 million (due to operating cash inflows).

At the same time, it is necessary to take into account the rather large stocks of sugar, grains and oilseeds in the company's balance sheet as of the end of the year (during the first quarter of 2023, Astarta quite actively reduced its stock). In general, in our opinion, the quality of the company's balance sheet is quite good.

As of December 31, 2022, the main item in the current assets was inventory. Sugar stocks amounted to EUR 96 million, while in physical terms - not less than 220 thousand tons (about EUR 400 per 1 ton, while in the 1st quarter of 2023 the average selling price of sugar by Astarta was EUR 640 per 1 ton). Stocks of grain and oilseeds – EUR 81 million (it refers to approximately 270,000 tons of corn, 50,000-60,000 tons of wheat, 40,000 tons of sunflower, the average cost is close to current sales prices).

During 2022, VAT receivables have increased - from EUR 34 million to EUR 47 million, taking into account the stabilization of the situation with VAT refunds in Ukraine in the fourth quarter of 2022 and the first quarter of 2023, in the future we expect a decrease of VAT balance.

From the point of view of financing structure, the company's own funds remain the main source. The debt burden as of 12/31/22 is EUR 70 million, so the ratio of the amount of goods for sale and cash to the amount of loans as of the reporting date was more than 3.5x. According to reporting standards, another EUR 109 million is Astarta's land lease obligations, but the nature of these obligations is completely different compared to loans, so it is considered by us quite separately from the ordinary loans.

In the second part of the review, we will share our impressions of Astarta's operational and financial results for 2022 as a whole.

EUR M

2021

2022

Sugar output*, k tons

266 282

Soybeans crush, k tons

172 211

Milk output, k tons

97 102

Revenue

491 510

EBITDA Total

201 155

EBITDA Sugar

36 35

EBITDA Grains growing

154 76

EBITDA soybeans crush

5 28

EBITDA Milk

9 18

Operating cash flow

57 39

In Y2022 the company increased sugar production from sugar beet from 266,000 tons to 282,000 tons, soybean processing - from 172,000 tons in 2021 to 211,000 tons. Milk production also increased - by 5% compared to the previous year to 102,000 tons.

In the grain growing segment, in 2022 Astarta received a good yield of corn (8.9 t/ha), sunflower (3.0 t/ha) and soybeans (2.9 t/ha), but the wheat yield decreased quite significantly compared to the previous year (from 5.8 t/ha to 4.8 t/ha).

From a sales perspective, Astarta was fortunate enough to sell most of the large 2021 corn crop in the fourth quarter of 2021 and the first quarter of 2022, so while the blockade of Ukrainian deepwater ports had an impact on the company's operations, the impact was not critical (in fact, we can only speak of delay by one quarter regarding wheat and corn Y2022 harvest sales).

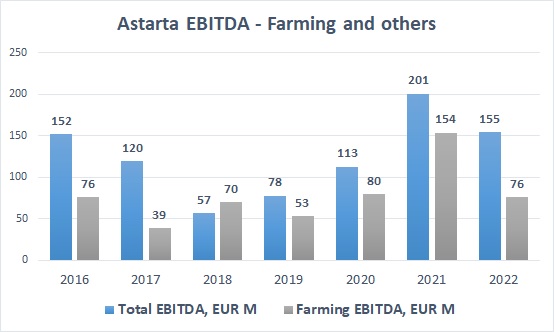

Grains growing segment EBITDA in 2022 amounted to EUR 76 million, compared to a record EUR 154 million in the previous year, while EBITDA was close to the average value of the last five years - due to good yields, despite all the difficulties, the group maintained the profitability of grain growing business.

Astarta reduced sugar sales from 285,000 tons in 2021 to 225,000 tons, but on the other hand, operating profitability increased, so the segment's EBITDA remained almost unchanged compared to last year (EUR 35 million). In the last quarter of the year, Astarta started to export sugar, which contributes to the timely sale of stocks and additional profitability (due to the abolition of customs duties on the import of sugar from Ukraine by the EU, the export price of Ukrainian sugar is currently higher than the domestic price).

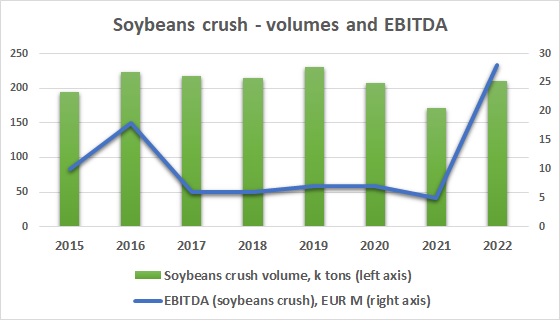

The results in the soybean processing segment were the best in almost the entire history of the activity (the reason - Astarta significantly increased the sales of soybean meal and oil to the European market, using new logistics routes with the overall high profitability of oilseed processing in the market - the domestic supply of oilseeds in Ukraine in 2022 significantly exceeded demand). The EBITDA of the segment amounted to almost EUR 28 million compared to only EUR 5 million in 2021.

In the segment of milk production, the situation was also not bad. EBITDA increased from EUR 8 million to EUR 18 million primarily due to the revaluation of biological assets (EUR 7 million), but even without taking into account the revaluation, the result was quite decent.

In total, for 2022, Astarta's EBITDA amounted to EUR 155 million, while the operating cash flow was only EUR 39 million. In fact, the operating cash flow of the grains growing segment was negative, which is associated with an increase in the net cost per 1 ha in 2022 (the company reported about the segment's profits, but needed to increase investments for the future harvest). Given the growth of sugar stocks, the cash flow from this segment was also minimal.

So from the point of view of generating cash flow in 2022 segments, principal ones were soybean processing and milk production. As per our estimates, they provided the lion's share of the positive operating flow).

Finally we can note the diversification and vertical integration of Astarta business. Different lines of activity support the profitability and liquidity of the company at different periods of time (soybean processing stagnated for seven years and demonstrated superior performance in 2022). At the same time, in recent years Astarta's debt burden has remained at a moderate level, so the overall financial standing of the company is quite acceptable.

Other news:

-

April 23, 2023

Kernel is losing market share among grain exporters

The largest Ukrainian agricultural holding has published its operating report for the first quarter of 2023 - sunflower crush has increased, grain exports are falling...

-

April 19, 2023

Corporate conflict around Kernel delisting evolves

Group of investors which own more than 20% of Kernel shares do not agree to delisting procedure...

-

April 17, 2023

In 2022, the revenue of ATB Market amounted to UAH 148 billion

In the reporting year, the total revenue of the ATB network remained almost unchanged compared to the previous year, the net profit decreased by two-thirds...