27 May 2023

One of the largest Ukrainian agriholdings IMC has published its financial report for 2022 and the first quarter of 2023.

$ M

2021

2022

Q1 2023

Corn sales, kmt

536 374 171

Sunflower sales, kmt

85 60 0

Wheat sales, kmt

117 42 30

Revenues

182 114 42

EBITDA

110 36 1

Operating cash flow

67 15 -2

Undoubtedly, IMC's biggest problem in 2022 was the fact that as a result of the Russian invasion and hostilities in the north of Ukraine, the company was unable to do plantation at about 32,000 hectares of its land bank.

Also, since IMC is a company fully focused on grains growing and sales, with corn usually accounting for more than 50% of total area, the blocking of Ukrainian ports for a large part of 2022 was also a huge blow to the business.

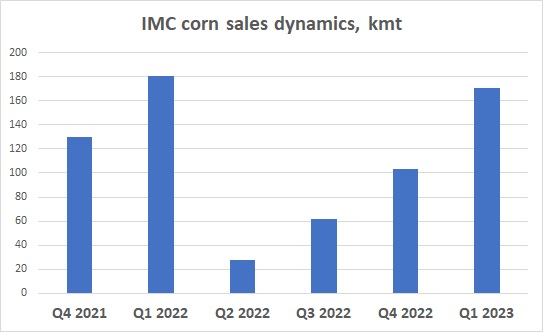

It should be noted that in February 2022, at the time of the full-scale invasion, approximately half of the near-record IMC corn crop of 2021 remained unsold. With a total harvest of 625 thousand tons, 130 thousand tons were sold during the fourth quarter of 2021, another 181 thousand tons were sold in January-February 2022.

At the beginning of the invasion, there were, according to our estimates, approximately 310-320 thousand tons of corn with a book value of $57 million (or about $185 per ton) on the IMC inventory stock.

This book value already included the profit from the revaluation of the corn crop, which the company reflected in 2021 financials (a general practice for agricultural holdings - a significant part of the company's profit related to grains growing is booked before the crop is sold, in fact - almost immediately after sowing).

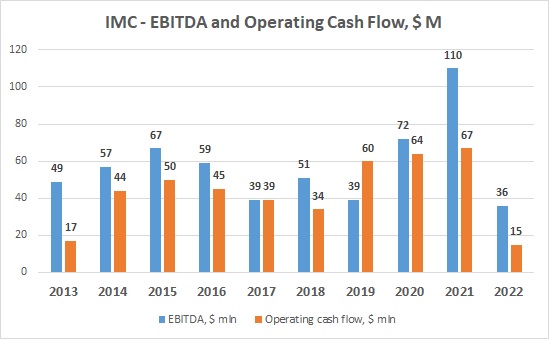

The total EBITDA of IMC in 2021, which actually reflected only the profit from the revaluation of the 2021 harvest, amounted to $110 million (almost $1,000 per 1 ha).

Throughout 2022, IMC sold the 2021 corn crop, moreover, in the first quarter of 2023, at least half of the total volume of corn sales (171,000 tons) was the 2021 crop.

The average sale price of corn during April 2022 - March 2023 was $206 per 1 ton, so, taking into account the increase in logistics costs for the delivery of grain to port terminals (deep-water and river), the sale of "old crop" corn against the net cost after revaluation was done with small loss, and the 2022 IMC EBITDA ($35 million) consisted of a revaluation of the 2022 harvest ($46 million).

In the first quarter of 2023, EBITDA amounted to $1.4 million, revaluation - $1.8 million. It means that after sale of 2021 corn harvest, despite its slow pace due to the difficult market situation, in general, IMC confirmed a significant part of the profits from the revaluation of the 2021 harvest.

As for the 2022/23 corn crop, harvesting of this crop was completed only in March 2023, and in the reporting quarter, IMC only started selling the new crop.

Thanks to favorable weather conditions, the yield of corn in the 2022/23 season was close to a record 10.5 t/ha, which allows us to talk about profitable activities of IMC in 2022/23 season.

Considering the profit from the revaluation of the crop, which was reflected by the company in 2022 (for corn - $38 million), as of March 31, 2023, the total book value of the corn on IMC Inventory stock was $62 million, or, according to our estimates, about $150 per 1 ton.

Taking into account the significant reduction in logistics rates for the transportation of grain by rail, starting from April-May, it can be expected that the sale of corn by the company in the following reporting periods will be profitable. Problems with the functioning of the grain corridor remain a risk - as of March 31, IMC, according to our calculations, had large (more than 400,000 tons) remaining corn stock that still needed to be exported.

As for other crops, in the last quarter of 2022 IMC sold the entire 2022 sunflower crop, and the growing of sunflower in the reporting year was quite profitable (according to our estimates, $400-500 per 1 ha), due to a good yield that exceeded 3 tons per 1 ha.

Sales of wheat took place with a significant delay. Out of the total harvest of 110,000 tons, as of the end of the first quarter, about 40,000 tons remained on stock.

As for the company's operating cash flow figures, in the reporting periods it was significantly affected by a significant slowdown in crop sales. As of March 31, 2023, the balance of the unrealized IMC harvest amounted to $69 million (for comparison, as of March 31, 2020 and 2021 - before the full-scale invasion - about $20 million).

During 2022 and the first quarter of 2023, the total value of operating cash flow was $13 million. This cash flow was fully directed to the payment of land lease obligations ($16 million), which from a formal point of view are not part of operating cash flow.

Amount of the company's cash has remained at a relatively stable level throughout 2022 and the beginning of 2023. As of the end of the first quarter of 2023, it amounted to $16 million.

We note that after IMC paid out more than $100 million in loans to creditors during 2014-2020, the company's total debt burden is low (about $35 million). Therefore, from the point of view of the structure and quality of the balance sheet, IMC has a fairly good margin of safety for further activity.

We will also remind you that in recent years (2017-2021), IMC has paid out more than $60 million in dividends to shareholders (which had a positive impact on the dynamics of the company's share price on the Warsaw Stock Exchange). We don't expect the company to pay a dividend after a difficult 2022, but the company's current performance and the balance sheet structure it maintains offer hope for financial performance improvement in the coming years and dividend payments renewal.