6 September 2023

The IMC company has published its financial report for H1 2023 2023 - profitable activity and an acceptable financial standing in general.

$ mln

Q1 2023

Q2 2023

H1 2023

H1 2022

Corn sales, kmt

171 158 329 209

Sunflower sales, kmt

0 0 0 0

Wheat sales, kmt

30 10 40 1

Revenue

42 30 72 44

Biological assets revaluation

2 21 23 30

EBITDA

1 16 17 29

Operating cash flow

-2 14 12 -8

In the second quarter of 2023, IMC sold 158,000 tons of corn and 10,000 tons of wheat. The average selling price of corn was $175 per 1t, which is significantly less than in the first quarter of the current year ($204 per 1t), as for wheat, the average selling price of it almost did not change and was about $220 per 1t.

The decrease in the sale price of corn was largely offset by a decrease in transportation costs (from $47 per 1t to $23 per 1t), so the profitability of corn sales compared to the first quarter of 2023 decreased by approximately $5-7 per 1t.

In total, in the first half of 2023, IMC sold 329,000 tons of corn (about 100,000 tons of it from the 2021 harvest, the rest from the 2022/23 harvest) at an average price of $190/t. With average logistics costs of $36 per 1t, this is equivalent to the average selling price at the silo on EXW terms at the level of $155-160 per 1t (for comparison, in 2021 this figure was at about $180 per 1t).

In the reporting period, 40,000 tons of wheat were sold at an average price of $221 per 1 ton.

In addition to above, sales in the reporting period the company booked the loss of $6.1 million related to write-offs of stocks due to its damage/quality problems.

Without taking into account this write-off, IMC operating profit (EBITDA) from the sale of the 2022/23 crop (and without taking into account the revaluation of the new season's crop) was close to zero. Taking into account the write-off, loss made about $6.5 million, which can be considered a pretty good figure, considering that agricultural companies reflect the main part of the profit from their activities in the form of revaluation of crops in field.

The profit from revaluation remains unrealized until the crop is sold, that is, at the time of sale, the company actually confirms (or not) the previous profits (revaluation related to Y2022/23 crop reflected in Y2022 financials made around $40M).

Since at the beginning of 2023 IMC still continued to sell the 2021 crop, so it is quite difficult to accurately separate the company's profits from the sale of 2022/23 season harvest (in addition, more than 200,000 tons of the 2022/23 crop remain unrealized as of June 30, 2023).

According to rough estimates, based on sales data in the first half of 2023 and estimates of the cost of growing IMC corn at the level of about $1,000 per 1 ha, due to high yields (10.5 t/ha in the 2022/23 season), EBITDA per 1 ha of corn was approximately $400-450 per hectare. Therefore, the total adjusted (for the amount of land lease payments) expected IMC EBITDA at the end of the 2022/23 season (assuming the sale of corn residues at prices not lower than the prices of the second quarter) is $30 million.

The profit from revaluation of biological assets (crops) of IMC in the first half of 2023 amounted to $23 million - until the time of harvest and sale, this profit will remain unrealized.

It should be noted that in the current year, the IMC is less aggressive in reflecting the profit from the revaluation of crops compared to the previous year (so, as of June 30, 2023, the book value of 1 ha of corn, taking into account the revaluation, is $826, while a year ago the figure made $1140 per hectare).

A more conservative approach, in our opinion, is reasonable in the current situation, taking into account all the risks associated with the export of grain from Ukraine.

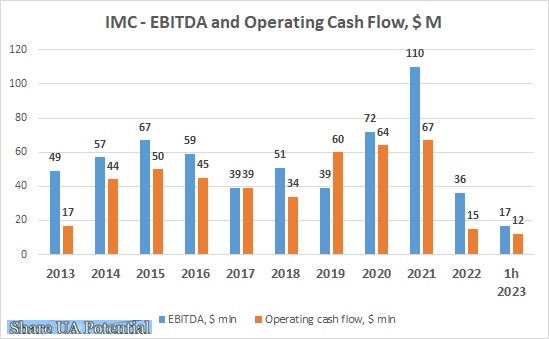

Due to the profit from revaluation of crops, IMC's EBITDA in the first half of 2023 amounted to $17 million, net profit - $6 million.

Since IMC sold a fairly significant amount of grain in the reporting period, the operating cash flow of the company before changes in working capital (in fact, before expenses related to 2023/24 crop growing) amounted to $27 million, taking into account expenses for sowing and other changes in working capital - $12.6 million. This cash flow was directed to land lease payments and reducing the credit burden (by $7 million).

Regarding the structure of the IMC balance sheet, it remains acceptable, even despite the relatively slow sales of grains. As of June 30, the company's assets included more than 200,000 tons of unsold products ($36 million), the value of biological assets (including revaluation of $23 million) amounted to $93 million, cash - $23 million.

Own funds remain the main source of financing the company's assets, as of June 30, debt burden amounted to $31 million, which is a relatively small amount as for the size of IMC's business (more than 110,000 hectares of land were sown this year).

Regarding the unrealized harvest, on the one hand, this is a risk for the company (especially considering the problems with the export of Ukrainian grain due to the termination of the operating of the grain corridor from Ukrainian deep-sea ports).

On the other hand, having an acceptable financial condition and a reserve of liquidity, as well as a grain storage capacity of more than 500 thousand tons, IMC can afford to sell products in line with working capital financing needs, hoping that with renewal of export from Ukrainian deep sea ports, domestic grains prices in Ukraine will increase.