31 May 2023

Despite the decline in output volumes in the last quarter of the year, Interpipe's financial results for the fourth quarter and 2022 as a whole were quite good.

Interpipe has released its key operating figures and financial report for the fourth quarter and full year 2022.

Q4 2021

Q3 2022

Q4 2022

Steel output, k tons

245 177 132

Pipe output, k tons

172 105 84

Wheel output, k tons

45 24 19

Pipes sales, k tons

180 84 102

Wheel sales, k tons

46 22 23

Revenues, $mln

377 226 294

EBITDA, $mln

77 73 81

As a reminder, despite difficulties with production (first of all, we note the constant shellings of Nikopol, where the facilities for seamless pipes production are located) and exports (due to the blockade of Ukrainian ports), due to the favorable situation on the market of seamless pipes and the lifting of restrictions on supplies to the EU and US markets, Interpipe's financial performance for the first nine months of the year was quite good.

Given the problems with energy supply in the last quarter of the year due to Russian missile strikes of the Ukrainian energy infrastructure, as well as the rather strong dependence of Interpipe's production on the availability of electricity, one could expect a deterioration of the company's operational and financial indicators compared to previous quarters.

A reduction in production volumes really took place during the last quarter of the year - steel production decreased by 26% q-o-q, and by 46% y-o-y. Pipes and wheels output figures were comparable to the dynamics of steel production.

On the other hand, the volume of products sales in the last quarter of 2022, on the contrary, increased compared to the third quarter (in the pipe segment - by 21%, the share of the segment in the total volume of sales of Interpipe is approximately 70%).

Taking into account that due to the favorable conditions of the global pipe market, the average sales prices of pipe products in the reporting quarter increased by 14% compared to the previous one (compared to last year - by 45%), the total revenue of Interpipe increased by 30% compared to the previous quarter and amounted to $294 million.

In the company's cost structure, the main share is the cost of raw materials (primarily – metal scrap) and energy sources (mainly electricity). Prices for scrap metal in Ukraine mostly decreased during 2022, so despite the increase in the cost of electricity, due to the increase in prices for sold products, the profitability of Interpipe remains very good.

In the fourth quarter of 2022, the group's EBITDA margin was 28%, total EBITDA - $81 million. Separately, we note that the company's operating cash flow during the reporting quarter amounted to $47 million, so the total amount of cash on the company's balance sheet at the end of December increased to almost $154 million (a year ago - $110 million), which is important from the point of view of the overall liquidity and stability of the business in the short- and medium-term perspective.

Regarding Interpipe's financial and operational performance for the entire year 2022, the situation is as follows.

2021

2022

Зміна, %

Steel output, k tons

972 595 -39%

Pipes output, k tons

615 393 -36%

Wheel output, k tons

172 84 -51%

Pipes sales, k tons

599 384 -36%

Wheels sales, k tons

174 87 -50%

Revenues, $mln

1133 981 -13%

EBITDA, $mln

228 204 -11%

Operating cash flow, $mln

57 162 2.8x

The total production of the main types of products decreased by 40% on average, sales in natural terms - by 37%.

Due to the significant increase in prices for Interpipe products during 2022 (prices for pipe products increased by almost 50% on average), the dynamics of the company's revenue was significantly better compared to sales in physical terms.

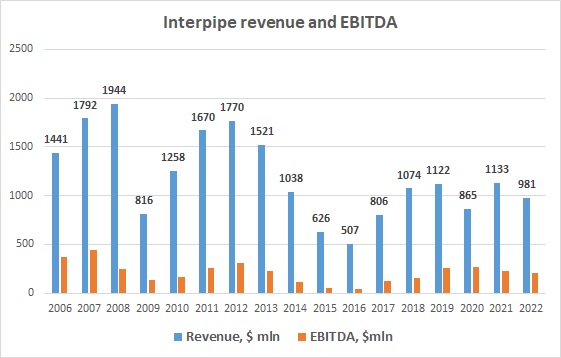

The total turnover of the group in 2022 made $981 million, the dynamics in recent years are shown in the graph below:

It should be noted that in the reporting year the company increased sales in the EU and American markets (the total share of these markets in the total revenue of the company in 2022 was 66%), while we also note reduction of sales in Ukraine (by 38% - primarily due to wheels sales slump, currently the share of Ukraine in the group's sales is about 20%) and other markets.

As Interpipe sells products with a relatively high added value, the share of logistics costs in the overall cost structure of the company is not critically high (in the structure of the full cost in 2022, on average - about 12%), so the increase in costs per 1t sales in 2022 compared to the previous year by more than two times was also not critical for the overall profitability of the activity.

Due to the increase in average sales prices, the decrease in domestic prices for scrap metal in Ukraine, despite the increase in electricity costs and additional logistics costs, in 2022 Interpipe's EBITDA margin remained almost unchanged compared to last year and amounted to 20.8%. The total EBITDA amounted to $204 million (versus $228 million in 2021), while the margin per 1 ton of sold products increased.

The company's operating cash flow (after interest and income tax) amounted to $162 million and was mainly used to pay off debt ($96 million, of which $52 million went to pay off debt to shareholders).

The structure of the company's balance sheet after the restructuring signed with creditors in 2019 and the haircut of a significant part of the company's debts is more or less balanced - the total debt as of December 31, 2022 was $390 million, while repayment of the main part of the debt ($300 million) should take place only in 2026.

As noted above, with total cash balance at the end of 2022 at $154 million, the company has a good margin of safety in the short term.

The biggest risks for Interpipe, as per our view, are the safety of assets located in Dnipro and Nikopol, as well as the risk of deterioration of the currently favorable situation on the global pipe products market.