19 June 2023

Having lost in volume terms, in the third quarter of the financial year 2022/23 Kernel focused on the most profitable types of operations.

In the reporting quarter, Kernel's performance fully corresponded to the general market situation with the Ukrainian export of grain and sunflower oil, primarily - restrictions on the operation of the grain corridor from Ukrainian deep-sea ports.

Given these constraints and the non-stable operation of the corridor, Kernel tried to export the products which provide for the maximum profit per ton. Despite the rather high margin of grain export in the reporting period, the processing and export of sunflower oil were still more profitable.

So it is not surprising that during January-March Kernel maximized sunflower processing and oil and meal exports, while grain exports decreased significantly both in comparison with the previous quarter and the same period of the last year (despite the fact that at the end of February 2022 the export of grain and oilseeds from Ukraine was actually stopped due to the full-scale invasion of the Russian Federation):

| 1Q FY2023 | 2Q FY2023 | 3Q FY2023* | 3Q FY2022 | ||

|---|---|---|---|---|---|

| Grains export, kmt | 732 | 1 522 | 824 | 2 136 | |

| Sunfloer seeds crush, kmt | 461 | 653 | 744 | 563 | |

| Sunoil sales, kmt | 202 | 345 | 273 | 269 | |

| Revenues, $M | 655 | 1 235 | 825 | 1 699 | |

| EBITDA Total, $M | 168 | 277 | 155 | -32 | |

| EBITDA Oilseeds crush, $M | 45 | 66 | 109 | -48 | |

| EBITDA Trading&Infrastructure, $M | 60 | 62 | 71 | 105 | |

| EBITDA Farming, $M | 81 | 204 | -24 | -64 |

In the reporting period, Kernel exported products mainly through the deep-sea ports of Ukraine in frames of the grain corridor, the share of alternative export routes was relatively small.

The company's total revenue during January-March was $825 million, 51% lower y-o-y, and 33% lower q-o-q. Kernel's EBITDA during January-March totaled to $155 million. This is less than in October-December, but if we take into account the profit structure, then in the previous quarter the main part of it was profit in the Farming segment ($204 million, partly due to the impact of the devaluation of the hryvnia on the net cost, this profit was also largely attributable to the sale of the 2021 crop).

In the current period, the result of this business direction was negative (-$24 million due to the write-off of assets, without which the result would be close to zero). Unlike the previous quarter, this result already reflects sales of the 2022 crop.

In its report, the company notes that in 2023, the application of fertilizers for the new season's harvest was significantly reduced, which may have a negative impact on this year's yields.

In other segments profits increased q-o-q.

We specially note the profitability of sunflower processing. In the reporting quarter, the EBITDA of the segment amounted to $109 million (including insurance compensation in the amount of $10 million), compared to $66 million in the previous quarter. At the same time, sunflower oil sales decreased by 21% compared to the previous quarter.

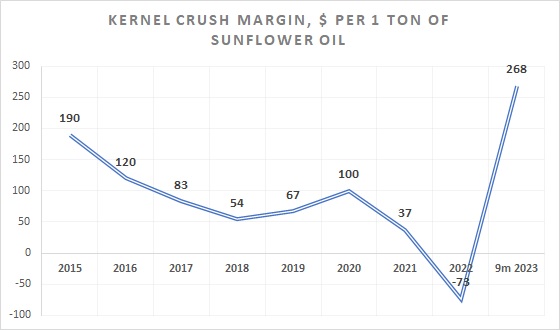

The profitability of oilseeds processing increased significantly - EBITDA per 1 ton of oil amounted to $399, while in October-December - $189. The figure of profit per 1t (even if insurance compensation is excluded from it) is an absolute record for recent years, its dynamics for previous years are shown in the graph below:

Such profitability clearly explains why in its export activities, under the conditions of significant restrictions in the reporting period, Kernel made a bet on sunflower oil export, sacrificing grains origination and export.

The results of the Trading and Infrastructure segment also look quite strong. EBITDA of the direction for January-March amounted to $71 million, in the previous quarter - $62 million. At the same time, grain exports decreased from 1.5 million tons to 824 thousand tons.

Reviewing the report for the previous quarter, we noted that the profitability of the segment was lower than expected, now the results are better than our previous estimates.

According to information from the report, during January-March, Kernel exported grain purchased in previous periods, when the margin for grain origination in Ukraine was at its maximum (it is interesting that in the reporting period Kernel exported more grain purchased from third parties than its own crop - this was rather unexpected).

Considering that this margin (more than $50-60 per 1t of grain), in addition to the pure origination/export margin, includes the profitability of wagons and the port terminal, in general, we can confirm such a good pnl per 1 ton of originated grain.

Because of the rather slow pace of export, the company's grain balances as of March 31 remained at a fairly significant level - 1.7 million tons. It is clear that Kernel does not want to sacrifice profitability for the sake of faster exports (otherwise the company would export more through alternative routes, for example, through the Danube ports). On the other hand, the Kernel remains dependent on the functioning of the grain corridor (with which there have been quite serious problems recently).

Due to the profitability of the business, the gradual reduction of inventories and the reduction of receivables (by $100 million in Q3), Kernel's operating cash flow for January-March amounted to $234 million. Given that there were almost no debt principal repayments in the reporting quarter, a relatively small amount was also directed to investments, the total amount of cash on the company's balance sheet increased from $679 million to $880 million.

In addition, we should note that according to the terms of the contract for the sale of farming assets (which operate 134 thousand hectares of land), in April Kernel received $100 million from the buyer (companies related to Andriy Verevsky), and the buyer must pay another $90 million in August. It is also important that the company's balance sheet as of March 31 contained about 1.7 million tons of grain and 156,000 tons of sunflower oil, which will be exported in the following reporting periods. The sale of these stocks will make it possible to get not less than additional $500 million.

On the other hand, Kernel has started negotiations with the banks financing the company regarding the extension of credit lines in the total amount of $909 million, which must be repaid in 2023, for one more year (the first extension took place in 2022).

If creditor approval for the loans prolongation is received, the group will have more than $1.5 billion in cash to finance operations in the new season, so the company can be very aggressive in purchasing grains and sunflowers. We also do not rule out further investment activity (recently Kernel acquired a river port terminal in Reni, an sunflower oil terminal in the port of Pivdenniy, and is also completing the construction of the Starokostiantyniv oilseeds crushing plant with a total oilseeds processing capacity of 1 million tons).