5 November 2023

Kernel keeps its focus on oilseeds crush, invests into logistics assets and demonstrates acceptable financial perofrmance.

As a result of the unstable operation of the grain corridor from Ukrainian deep-sea ports, Kernel's financial results in the fourth quarter of the financial year 2023 (April-June 2023) have deteriorated compared to previous reporting periods, but for the 2023 (financial) year as a whole, they are completely acceptable.:

| 1Q FY2023 | 2Q FY2023 | 3Q FY2023 | 4Q FY2022 | |

|---|---|---|---|---|

| Grains export, kmt | 732 | 1 522 | 824 | 627 |

| Oilseeds crush, kmt | 461 | 653 | 744 | 644 |

| Revenues, $M | 655 | 1 235 | 825 | 740 |

| EBITDA Total, $M | 168 | 277 | 155 | -56 |

| EBITDA Oilseeds crush, $M | 45 | 66 | 109 | 50 |

| EBITDA Trading&Infrastructure, $M | 60 | 62 | 71 | -40 |

| EBITDA Farming, $M | 81 | 204 | -24 | -40 |

The situation in the oilseeds processing segment remains the best. In the last quarter of the financial year, Kernel crushed 644 thousand tons of sunflower seeds, which is more than the average value for the year.

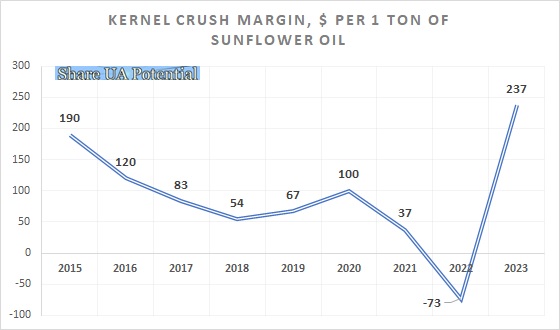

The volume of sunflower oil sales during April-June amounted to 319 thousand tons, which is also quite a high figure, but at the same time, crush margin decreased compared to previous periods - the total EBITDA of the segment in the reporting quarter made $50 million, or $157 per 1 ton of sold sunoil (on average for the financial year, the profit per ton was $237).

In the grain trading segment, the EBITDA in the last quarter of the financial year was negative at -$40 million. The company notes that such a result is a consequence of the problems with grain corridor from Ukrainian ports operations.

In our opinion, the result is quite low, even taking into account the unstable operation of the corridor. So we can conclude that in the reporting period the company booked, among other things, detention and demurrage costs related to the vessels executed in previous reporting periods (so this is an adjustment of previous periods profits).

Similar result (loss at the EBITDA level in the amount of -$40 million) in the reporting quarter was shown by Farming segment. The main reason is the revaluation of inventories and biological assets (crops in fields) due to a significant decrease in world grain prices, as well as high expected additional logistics costs associated with the export of grain through the Danube ports due to the termination of the grain corridor out of Ukrainian Black Sea ports in July 2023.

The amount of loss from the revaluation of biological assets and inventory stocks during April-June 2023 amounted to $103 million. The revaluation of biological assets, as well as the devaluation of the hryvnia, introduce elements of ambiguity into Kernel's financial performance assessment, therefore, in our opinion, it is important to pay special attention not only to the profit and loss figures, but also to the operating cash flow of company and its components.

The total EBITDA loss of the group in the last quarter of the financial year was -$56 million. Moreover, since part of the loss is a revaluation of inventories and crops (that is, in fact, an expected unrealized loss), the company's operating cash flow before changes in working capital (but after interest payments and paid income tax) was positive and amounted to $59 million.

Due to the seasonal decrease in inventories, the total figure of operating cash flow in the reporting quarter was $133 million.

* - negative EBITDA in April-June 2022 due to impairments and write-offs due to war impact.

In addition, Kernel received $90 million in cash from companies related to Andriy Verevskyi for the farming asset that was sold in 2022 (with a total land bank under management of 134,000 hectares).

The funds received in the reporting quarter were directed to following items: 1) $40 million - to repay debt obligations; 2) only about $16 million for capital investments and the purchase of assets; 3) a deposit in the amount of $123 million was placed as security for credit obligations.

As for impairments/write-offs, during April-June, the company revalued/wrote off $65 million of inventory, as well as about $30 million of financial assets (these items directly affected the profit of the reporting period).

Excluding the $123M deposit, the amount of cash on Kernel's balance sheet as of June 30, 2023 was $954 million ($881 million as of March 31, 2023).

Also, the company's assets as of the end of the reporting period include inventories in the total amount of $341 million (compared to $954 million a year ago), biological assets (crop in fields) with a book value of $146 million ($160 million), receivables and prepayments to suppliers for $457 million and tax assets (primarily VAT for reimbursement for $162 million).

Against these assets, as of the reporting date, Kernel had $1.5 billion of debt (excluding land lease liabilities), accounts payable and other liabilities of $310 million.

In total, as of June 30, 2023, Kernel's current assets exceeded current liabilities by $540 million, which indicates an acceptable balance sheet structure and liquidity of the company (especially considering prologation of short-term loans in the amount of $778 million until mid-2024).

The book value of equity as of the end of the reporting period amounted to more than $1.7 billion. For comparison, before the start of the full-scale invasion (on June 30, 2021), it was $1.9 billion, the difference was mainly due to the depreciation of fixed assets because of the negative impact of Russian aggression. The balance sheet structure as of June 30, 2023, as well as the end of the 2021 and 2022 financial years, looked as follows:

Kernel Balance Sheet structure

30.06.23

30.06.22

30.06.21

Total Assets

3 885

4 185

3 996

Fixed Assets

1 443

1 662

1 713

Current Assets

2 442

2 523

2 284

Inventory*

489

1 116

709

Cash

1 077

448

574

Equity

1 744

1 686

1 948

Debt

1 474

1 696

1 085

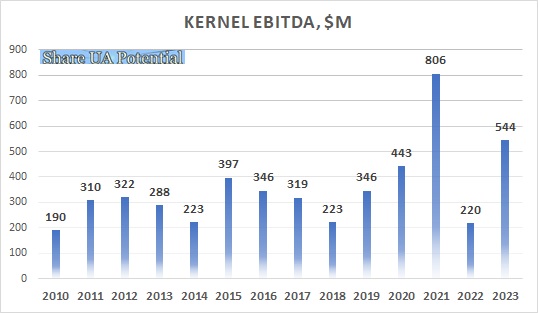

Regarding the financial results for 2023 as a whole, in its report the company focuses on several main indicators - EBITDA in the amount of $544 million, net profit of $299 million, as well as profit from currency revaluation (related to the impact of the devaluation of the hryvnia on the net cost), which is offset by a loss of -$241 million, which is not part of the income statement, but directly reduces the company's equity.

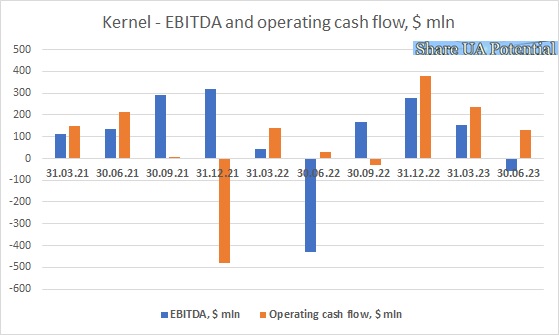

If you look at the financial performance from the point of view of operating cash flows, the impact of the impossibility of exporting grain and oilseeds during a significant part of 2022 was significant, which led to huge overstocking. Accordingly, for the first nine months of FY2022 (July 2021 to March 2022), Kernel's EBITDA was $509 million, but operating cash flow was negative at -$335 million.

On the contrary, in financial year 2023, when Kernel realized destocking, EBITDA made $544 million and operating cash flow was $716 million.

Kernel Holding financial performance

| $ mln | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 3 455 | 5 331 | 5 595 | 4 107 |

| Gross Profit | 636 | 652 | 906 | 462 |

| EBITDA | 544 | 220 | 806 | 443 |

| EBITDA margin, % | 16% | 4% | 14% | 11% |

| Net Profit | 299 | -41 | 506 | 123 |

| Operating cash flow | 716 | -305 | 461 | 269 |

| Financing cash flow | -216 | 476 | -48 | 226 |

| Investing cash flow | 10 | -294 | -205 | -203 |

Looking at the results for the two years as a whole (from July 2021 to June 2023, which makes sense because in FY2023 Kernel was actively selling its record-high 2021 crop), Kernel's EBITDA was $764 million, including the loss from the revaluation/write-off of fixed assets in the amount of $330 million, as well as the write-off/impairment of inventories in the amount of $164 million.

During the same period (FYs2022-23), operating cash flow before changes in working capital was slightly more than $1 billion, while total operating cash flow made $411 million.

Meanwhile the amount of the company's debt increased by $437 million (this happened during July - December 2021), and it also received $113 million from companies related to Andriy Verevsky for the assets sold to him.

Where were these funds directed to? Back in the fall of 2021, Kernel bought back its own shares from the market for $97 million, and also paid dividends to shareholders in the amount of $34 million. Also, within two years, the company paid $34 million for land lease. Investments in fixed assets and M&A activity amounted to approximately $210 million, in addition, Kernel lost more than $50 million on cryptocurrency transactions.

The amount of cash on the company's balance sheet as of June 30, 2023 increased by $503 million compared to June 30, 2021.

The overall performance of the company during almost two years of full-scale war can be called as quite acceptable, the current financial standing of the company is close to what it was before the full-scale invasion (at the same time, obviously the risks of activity have increased significantly).

In terms of performance by segments, the EBITDA in the sunflower processing segment was the highest in the entire history of Kernel's existence - $237 million (in the 2022 fiscal year, there was a loss of -$73 million at the EBITDA level due to the write-off and impairment of assets in the amount of $185 million, in 2021 financial year the profit was at those-time record-low of $37 million).

The total amount of sunflower seeds crush in the 2023 financial year was 2.5 million tons (2.2 million tons in FY2022 and 3.2 million tons in FY2021).

The record-high crush margin was the result of high sunflower stocks in the country at the beginning of the invasion on the one hand, and closure of several processing plants due to war and occupation on the other. Also taking into account logistic export restrictions, in the 2022/23 season crushers had much more purchase power vs. the farmers.

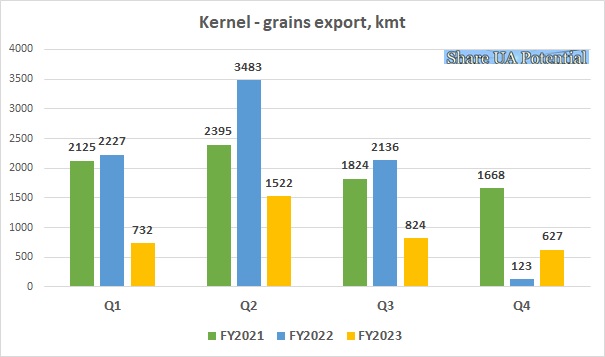

In the Trade and Infrastructure segment, grains export volumes decreased significantly - from 8 million tons in both financial years 2021 and 2022 (despite the actual absence of exports in March-June 2022) to 3.7 million tons in FY2023.

Despite this, Kernel remained the number one exporter of grain from Ukraine with a share of 8% (the closest competitor - Louis Dreyfus - share stood at 7%). Kernel started the financial year with stocks of 1.8 million tons of grains. In the reporting year, Kernel collected about 2 million tons of grain of its own harvest, while origination from third parties amounted to 1 million tons (seven times lower than in previous season).

By the end of the financial year, the company's grain stocks decreased to 1.1 million tons. We expect that if Ukrainian Black Sea ports will be blocked in the new season, Kernel will focus on exporting current stocks and its own harvest (as in the season 2022/23). If the deep-sea ports will work, the company will be much more active in grains origination from the 3rd parties (but giving priority to its own harvest and oilseeds processing products).

EBITDA of the segment in FY2023 amounted to $154 million ($237 million in the previous financial year, the decrease mainly related to Kernel's Swiss trading company - Avere). On the other hand, the company particularly notes good results from operating a fleet of grain railcars.

In the Farming segment the situation was probably the worst. The segment's EBITDA amounted to $221 million, but, firstly, the main part of the profit was related to the sale of the 2021 harvest, and secondly, a large part of the profits resulted from an impact of UAH devaluation on the net cost of sold goods. The good yield of the main grains and oilseeds crops in 2022 also helped the company significantly.

Regarding the 2023 crop, for the first time in a decade, Kernel has already reflected the expected loss from harvesting and marketing of the crop in its reporting, even despite the good expected yield (corn – 9.3 t/ha, sunflower – 3.0 t/ha). The amount of the loss is $27 million, it is reflected in the line Net change in fair value of biological assets. As it is unrealized, it can be expected that if Ukraine will be able to export grains and oilseeds products through the Black Sea deep-sea ports, the results of the segment will soon improve significantly.

Finally, a few words about the company's current and planned investments. In the oilseeds crush segment, the company plans to complete construction of its largest oilseed processing plant in Starokostyantyniv in the next financial year (+1 million tons of oilseed processing per year for the group). In the trading segment, the company invests in oil terminals in the Chornomorsk, Pivdenniy and Danube, as well as in a grain terminal in Reny (in order to guarantee itself the possibility of exporting grains at least of its own harvest in case the deep-sea Black Sea ports do not function).

Also, for the first time in its history, Kernel invested $18 million in the purchase of two vessels - the Eneida bulker of 44,000 tons and the Mavka tanker (12,500 tons). In this way, the company can at least partially eliminate the reluctance of ship owners to enter Ukrainian ports due to military risks (Eneida became one of the first ships that passed through the new temporary corridor from Ukrainian ports in the fall of 2023).

But the main news for the company in recent months (if you do not take into account the big corporate scandal and the unfriendly actions of Andriy Verevskyi and the Board of Directors towards other shareholders of the company - this case will be considered by a court in Luxembourg) was the prolongation of the main part of the company's short-term loans until the middle of 2024 (along with it the group is ready to repay its debt with a 25% discount).

Debt prolongation significantly improves Kernel's current liquidity situation, so we stand by our opinion - things at the company continue to go well (much better than could be expected assuming full-scale war).