19 September 2023

What was the financial performance and how did Kernel's financial standing evolved before and during the full-scale Russian invasion.

In a recent interview with Latifundist, Kernel Group's new CFO said the company has been on the brink of default since the full-scale invasion began.

Such a statement is primarily based on the fact that most of the company's obligations to creditors are short-term, therefore, in order to continue normal business operations, most of the short-term obligations ($1.5 billion) must be rolled over, despite the presence of a significant amount of cash on the company's balance sheet as of the latest reporting dates ($1.1 billion as of June 30, 2023).

In theory, if the banks refuse to extend the loans, and Kernel refuses to repay the debt, a formal event of default may occur. In practice, such a development does not meet the interests of either the creditors or the company itself. Lenders first extended Kernel's short-term debt in 2022 until June 2023, in the same year 2023, Kernel applied to financial institutions to extend the debt until mid-2024.

According to the CFO, it was the company's creditors who set the condition for additional support of Kernel by shareholders, which led to the announcement of a tender, as a result of which Andriy Verevsky significantly diluted the share of minority shareholders. We consider the amount raised in the tender as relatively small for the size of the company's business.

Recognizing the need to extend Kernel's loans to keep the operations scale, we looked at what has happened to Kernel's financial standing since the start of the full-scale invasion and where the company currently stands in terms of financial standing.

Financial information

$ mln

9ì 2023

2022

2021

Revenue

2 715

5 331

5 595

EBITDA

600

220

806

Net income

437

-41

506

31.03.23

30.06.22

30.06.21

Assets

4 040

4 185

3 996

Fixed assets

1 475

1 662

1 713

Current assets

2 565

2 523

2 284

Inventory

660

1 116

709

Cash

881

448

574

Equity

1 877

1 686

1 948

Debt

1 522

1 696

1 085

9ì 2023

2022

2021

Operating cash flow

582

-305

461

Financing cash flow

-186

476

-48

Investing cash flow

39

-294

-205

Let's begin with a brief description of the general situation in the grain and oilseed markets of Ukraine before and after the start of the full-scale invasion.

In the second half of 2020, a cycle of significant growth in world prices for the main grain and oilseed crops began.

The first phase of the cycle ended in May 2021, after which world prices fell for several months, but already in September the second phase of the cycle began, as a result of which, for example, corn prices reached an all-time high in April 2022, already after the beginning of full-scale Russian invasion of Ukraine.

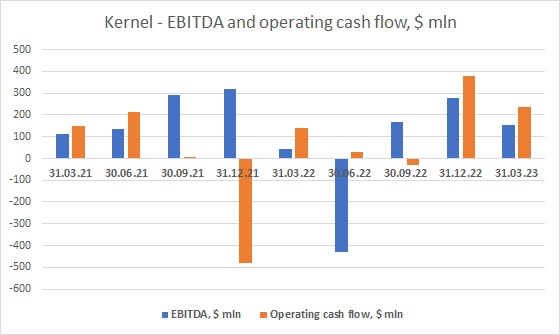

As a result of the significant increase in global prices, the financial year 2021 (July 2020 - June 2021) became the most successful year for Kernel in the entire history of the company. The company's EBITDA made $806 million, operating cash flow - $460 million.

The difference between the operating profit and the amount of operating cash flow mainly consisted of biological assets (crop in filed) revaluation ($132 million, revaluation of biological assets/crops is a standard practice for an agro-company, and is a classic example of "paper profit" that is realized after harvesting and selling the crop) and paid interest on financial liabilities ($133 million).

Financial year 2021 (June 30, 2021) Kernel ended with cash on hand in the amount of $574 million (compared to $369 million at the end of fiscal year 2020), inventories of $332 million and future harvest on more than 500 thousand hectares of land (with book value of $377 million, which included the above-mentioned revaluation of $132 million). To finance these assets, $1.1 billion in financing was raised, of which short-term financing was at about $300 million.

The total debt burden seemed absolutely adequate for the size of Kernel's business, the financial standing of the company was considered as quite good.

Financial year 2022 started even better than the previous one. Firstly, the second phase of the global prices growth cycle has begun, and secondly, in 2021, Kernel (as Ukraine in general) harvested a record crop of grains and sunflower seeds. The combination of these two factors led to very strong financial results in the first half of fiscal 2022 (July 2021 - December 2021).

Kernel's EBITDA for the first nine months of fiscal year 2022 was $608 million, operating cash flow before changes in working capital was $605 million.

At this point, it is necessary to draw the reader's attention to the seasonality of business and seasonal needs for working capital financing.

In addition to farming, Kernel's main business areas are sunflower processing and grain trading. So it is important for the company to be able to purchase large volumes of grains and sunflower seeds immediately after their harvest, when the domestic price for these products is close to the minimum (more precisely, the difference between the domestic and world prices is the maximum).

Kernel usually raises additional loans in July-August to finance such a seasonal purchases, repaying these loans already in the spring. For instance, in the financial year 2021, the amount of such loans made about $250 million.

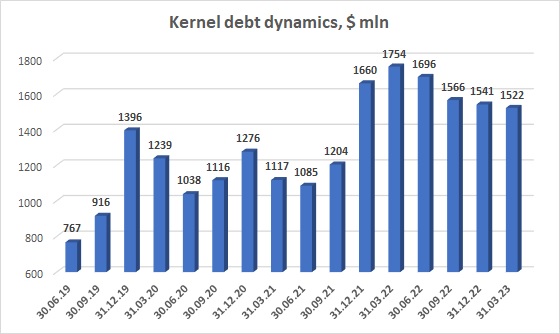

Due to the record harvest of 2021 in Ukraine, Kernel aimed to the record volumes of sunflower seeds crush and grains export. Also, as of the autumn of 2021, grain and oilseed prices were significantly higher than a year ago. All this led to the fact that Kernel attracted an additional $600 million for seasonal financing of operations, its debt increased from $1.1 billion at the end of June 2021 to almost $1.7 billion at the end of December.

Against this debt, the company immediately had $1.5 billion in inventory (versus $961 million last year) and $454 million in cash, so the balance sheet structure looked good.

In addition, using the profits earned (more than $1 billion for July 2020 - February 2023), Kernel actively invested in development, repurchased its own shares from the market (in the 2022 financial year, $97 million was directed to share buyback programs), and even in the third quarter of financial year 2022 (January-March 2022) made an investment in cryptocurrency in the amount of about $150 million (calling it a tool for managing excess liquidity in its financial report).

The full-scale Russian invasion of Ukraine led to a complete shutdown of Ukrainian deep-sea ports. During March-April, Kernel activity was actually stopped. Two oil processing enterprises remained in the occupied territory of the Kharkiv region, as a result of the military operations, the company wrote off about $100 million in inventory.

In general, the invasion found Kernel with the maximum inventory of commodity products that could not be exported, as well as the maximum amount of credit loans. As of March 31, 2022, the amount of cash on Kernel's balance sheet was $373 million, while in terms of financing needs at that time - primarily, it was the need to finance the 2022 crop (as well as current salary payments and interest on loans).

What was happening inside the company during the period of time, how the financial plans were made, is difficult to say, but to cover potential liquidity problems, on April 26, 2022, Kernel decided to sell part of the company's assets, namely the farms that operated the land bank in 134 thousand hectares, to legal entities related to the founder and the biggest shareholder of Kernel, Andriy Verevsky.

Considering that at that time the cryptocurrency was still on the Kernel balance, the fact that in April Ukraine had already started exporting grain and oil via alternative routes, and Russian troops had already been pushed back from Kyiv (so the threat to the very existence of the country was much less than at the beginning of March), selling one of the company's best assets to improve its liquidity with deferment of payment term seemed a bit strange (immediately Verevsky paid to Kernel only $20 mln).

Investors on the WSE did not appreciate the sale of assets to Verevsky, so in Y2022 Kernel had the worst share price dynamics among all Ukrainian public companies (later Verevsky took advantage of this by offering a low buyout price of shares in the tender at the beginning 2023, having justified the proposed price by the company's low quotations on the Warsaw Stock Exchange in the second half of 2022).

Anyway, Kernel was able to do sowing campaign in 2022, and as of June 30, 2022, despite the asset losses, its balance sheet structure looked acceptable. Debt remained almost unchanged at $1.7 billion, with $448 million in cash, $150 million in crypto-assets, $954 million in inventory, and $162 million in crops in fields. All these assets fully covered the debt, and repayment of short-term liabilities was deferred until mid-2023 year

In August 2022, the grain corridor out of Ukrainian ports began operating, due to significant stocks of grain and sunflower seeds in the country, the margin of grain exporters (owners of logistics assets such as port terminals) and the profitability of sunflower crushers reached the highest marks in the last decade, and the profitability of Kernel's operations also increased significantly.

Despite the decline in volumes of operations (the main problem was the unstable operation of the grain corridor and the long queue of ships for inspection in Istanbul), the financial results of Kernel were good. For the period July 2022 - March 2023, Kernel's EBITDA made $600 million, operating cash flow - $583 million (in addition to profit, Kernel gradually reduced inventory balances). On the top the company expected to receive $190 million from Andrii Verevsky for the assets sold in April 2022.

*- Negative cash flow in October-December 2021 was caused by additional working capital financing needs due to rising grain and oilseed prices and increased origination due to a record harvest in Ukraine.

** - Negative EBITDA in April-June 2022 due to write-offs related to the impact of military operations.

Due to profits, reduction of inventory, sale of cryptocurrency (in October-December 2022, $111 million), Kernel significantly increased the amount of cash - up to $881 million as of March 31, 2023 (according to the company's additional announcement - up to $1.1 billion as of 30 June 2023), reducing the amount of debt to $1.5 billion. The debt was still by 100% covered with cash and inventory stocks.

In total, for April 2022 - March 2023, Kernel's EBITDA was $170 million, operating cash flow before changes in working capital - $706 million (the difference from EBITDA is due to the write-off of assets after the start of the invasion), total operating cash flow - $613 million. During that period of time, the company paid creditors $132 million in interest on loans, $225 million in debt, directed about $60 million to investments and increased the amount of cash on the balance sheet from $373 million to $881 million.

As we can see, during the period of the full-scale Russian invasion, the financial standing of Kernel, at least, did not worsen, so we can speak about the potential default only formally in the context of the prolongation of short-term credit agreements.