2 October 2023

The company has improved operational and financial performance in the chicken production segment, and intends to refinance short-term debt.

$ mln

Q2 2023

Q1 2023

Q2 2022

Poultry sales, kmt

178

188

140

Average poultry price, $/kg

1.95

1.85

2.03

Sunoil sales, kmt

169

77

48

Revenues

809

746

595

EBITDA

101

117

111

Operating cash flow

178

96

-46

During the first half of 2023, the poultry production capacity utilization of MHP was close to 100%, which was reflected in the company's operational and financial results.

In the second quarter of 2023, the total volume of MHP poultry meat output in Ukraine amounted to 181.7 thousand tons, which is 2.3% more than in the previous quarter and 6.6% more than in the second quarter of 2022.

In general, in the first half of 2023, the company's poultry production in Ukraine increased by 4% y-o-y.

The volume of poultry meat sales in the reporting quarter increased significantly compared to last year (exports increased by 46% due to the low base of comparison, sales on the domestic market increased by 8%).

The average selling price of chicken meat in Q2 2023 was 5% higher q-o-q, but 4% lower y-o-y. The reason is a significant drop in chicken prices on main export markets in the second half of 2022 (so the average export price has decreased by more than 15% compared to last year).

The dynamics of chicken prices on the domestic market was better (mainly because of low base of comparison), y-o-y growth rate in USD terms made 9% (in UAH - 36%), q-o-q the average selling price on the domestic market increased by 8%.

Despite the increase in prices on the domestic market, the average export price in the reporting quarter was still significantly higher than the sale price on the domestic market ($1.56 per 1 kg and $2.22 per 1 kg, respectively). In the reporting quarter, the share of exports was 56% of the total volume of chicken sales (in tons).

It should also be noted that in the reporting quarter, sales of sunflower oil increased significantly - up to 169,000 tons compared to 77,000 tons in the previous quarter and to only 48,000 tons in the second quarter of 2022.

Given the high profitability of sunflower and soybean processing in early 2023, it is logical that MHP is trying to maximize oilseeds crush volumes. The company is clearly the number two exporter of sunflower oil from Ukraine (second only to Kernel).

Due to the increase in the volume and profitability of sunflower processing, as well as the increase in the average selling price of poultry meat, in the second quarter of 2023, the profit of the segment increased compared to the previous quarter (EBITDA of the segment increased from $97 million to $124 million).

In total, for the first half of 2023, the EBITDA of the MHP chicken production segment was $221 million (vs. $100 million in the first half of 2022).

Due to the decline in global prices for grains and oilseeds in recent months, as well as the existing correlation between grain and chicken prices, the company expects that global chicken prices may decrease in the next reporting periods, leading to lower segment profitability.

In the grain growing segment, MHP's revenue in the first half of the year amounted to $93 million, and the activity (at the EBITDA level) was unprofitable (-$13 million). The company does not disclose sufficient details of the segment's financial results in the reporting period, but we see the following reasons for such results.

Firstly, the company rather aggressively revalued its biological assets and yield in 2022 (according to the financial report for 2022 EBITDA per 1 ha was $273), secondly, the yield of late MHP crops in 2022 was quite low (corn yield – 7.2 t /ha against 10 t/ha in 2021).

So after selling of the grain (partially in-house), the company could not confirm the profit that was unrealized until the time of sale (the revaluation of biological assets and the unrealized profit related to it is a common practice for agricultural holdings).

In H1 2023, according to the company's report, revaluation of crops was less aggressive compared to previous year. On the other hand, a much better result is expected in terms of the yield of grain and oilseed crops (as for early grains, the yield of wheat in the MHP was 6.6 t/ha, rapeseed – 3.7 t/ha), but at the moment grain prices in Ukraine are low.

Fairly good financial results in the reporting period (the second quarter of 2023 and the first half of the year as a whole) were demonstrated by the European segment of MHP - the Slovenian Perutnina Ptuj. The company's sales volume in tons increased by 10% y-o-y, revenues grew by 19% (up to $267 million), EBITDA amounted to $39 million.

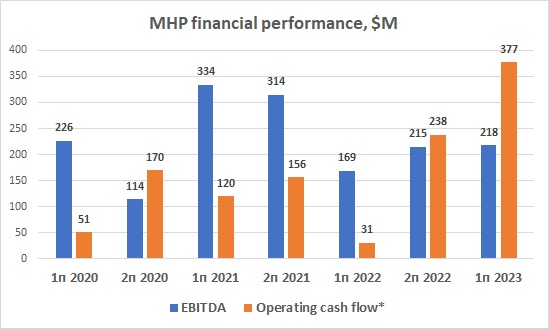

*-operating cash flow before interest and income tax

*-operating cash flow before interest and income tax

From a positive point of view, we also note that the company's operating cash flow before changes in working capital and interest payments for the first half of 2023 amounted to $309 million (a year ago - $276 million), after changes in working capital (due to seasonal sales of grain) - $377 million

The funds were used to pay interest on debt obligations ($96 million) and investment activities ($102 million, mainly investments in asset maintenance, the development of Perutnina Ptuj and the development of MHP as a culinary company with the opening of new retail outlets).

The amount of MHP cash increased from $300 million as of December 31, 2022 to $502 million at the end of the first half of 2023.

The total amount of debt obligations (excluding land lease obligations) is currently 1.7 billion (almost unchanged compared to the figure as of the end of 2022).

Earlier we noted that the need to repay Eurobonds in the total amount of $500 million in May 2024 as the biggest financial risk for MHP. In its presentation to investors the company announced that it had reached an agreement with a number of international financial institutions regarding the conclusion of loan agreements for a total amount of up to $400 million.

These funds will be directed to the refinancing of bond obligations, so MHP has already announced a tender for the purchase of bonds maturing in 2024.

With this refinancing, the company should solve the main problem regarding liquidity for the following years.

The new financing will have a repayment schedule over the next six years, while the other MHP Eurobonds (for a total of $900 million) mature in 2026 and 2029.

In the case of successful refinancing of bond obligations, with significant cash balance, MHP currently has a good margin of safety in its activities, the company should not have problems with the implementation of the nearest plans, including the seasonal purchase of sunflowers for processing and launching a joint venture in Saudi Arabia.

The general financial standing of MHP is acceptable.