March 13, 2024

In 2023, the turnover of the Obolon company amounted to UAH 10.8 billion, which was 24% higher than the previous year, net profit made UAH 1.8 billion.

According to the official financial report of one of the largest producers of beer and soft drinks in Ukraine - PJSC Obolon - its turnover in 2023 amounted to UAH 10.8 billion, which is 24% more than in 2022 (8.7 billion UAH).

The company's operating profit also increased significantly - from UAH 1.7 billion in the previous year to UAH 2.2 billion in the reported year, while net profit increased from UAH 1.2 billion to UAH 1.8 billion.

As for the sales structure, beer accounted for about 60% of the company's total turnover over the past few years, non-alcoholic and low-alcohol products – about 10-12% of turnover (each one). For the year 2023, there is currently no data on the sales structure - we are waiting for the publication of the company's consolidated audited report).

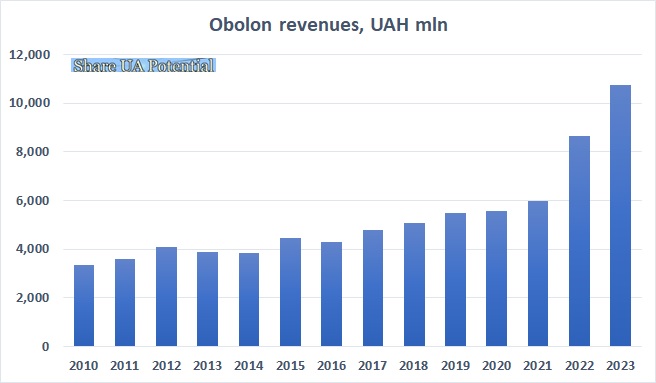

We note a significant improvement in the company's turnover and profitability compared to the years before the full-scale invasion. Revenue dynamics is presented in the following graph:

Regarding profitability figures, in 2020 the net profit of PJSC Obolon amounted to only UAH 77 million, in 2021 the company suffered a loss in the amount of UAH 112 million (then, as mentioned above, in 2022 net profit was UAH 1.2 billion, in 2023 it was UAH 1.8 billion UAH).

Due to significant improvement of financial performance, during 2022-23 the company largely improved its overall financial position.

As of December 31, 2021, the total amount of Obolon's bank loans was about UAH 1.6 billion, by the end of 2022 this amount had decreased to UAH 880 million, and as of December 31, 2023, it made only UAH 225 million. This means that during years 2022-2023, Obolon paid out about 1.4 billion loans. Moreover, additionally, the amount of money in the company's accounts increased from UAH 139 million as of December 31, 2022 to UAH 475 million by the end of 2023.

The main source of financing the company's assets at the moment is its own funds - the equity capital of PJSC Obolon as of December 31, 2023 amounted to UAH 5.2 billion (with total assets of UAH 7 billion).

If at the end of 2021 the financial condition of the company looked very mediocre, now the situation has fully changed.

The reason for such dynamics is simple - the problems of competitors.

Due to the fact that the breweries of one of the largest beer producers in Ukraine in recent years - AB InBev - in Chernihiv, Mykolaiv and Kharkiv remained closed from the beginning of the full-scale invasion until December 2022, this company lost 70% of its sales in 2022.

The largest brewery of this group in Ukraine - in Chernihiv - was damaged during the shelling of the city by the Russian army in the spring, while the company began to partially resume production only in December 2022 (the plant in Kharkiv remains inactive to this day).

As a result, the revenue of AB InBev Ukraine in 2022 amounted to UAH 2.3 billion, 67% lower than in the previous year. In 2023 the turnover increased to UAH 4.7 billion, but even in UAH it remains smaller compared to 2021 (UAH 6.8 billion).

Another big competitor, Carlsberg Ukraine, is doing better (the company’s revenue in 2023 increased by 20% compared to the previous year to UAH 10.8 billion), but so far the competitive environment for Obolon is still much better than in the years before the full-scale invasion, so the company used the opportunity to strengthen its overall financial stability.