30 November 2023

For the first nine months of 2023, Ovostar's net profit made $29 million, operating cash flow was $67 million.

Ovostar has published its financial report for January - September 2023.

The main operating and financial figures are shown in the table:

Q3 2023

9m 2023

9m 2022

Eggs output, mln

416 1148 1190

Shell eggs sales, mln

256 734 824

Shell eggs export, mln

72 280 223

Revenues, $ mln

34 123 90

EBITDA, $ mln

10 32 6

Operating cash flow, $ mln

11 67 11

Adjusted operating cash flow*, $ mln

8 48 10

In the reporting quarter, Ovostar produced 416 million eggs, which is the highest value since the second quarter of 2022. Compared to the previous quarter, egg production increased by 9%.

In just the first nine months of 2023, the total production of eggs by the company amounted to 1,148 million pieces, 3.5% less than last year.

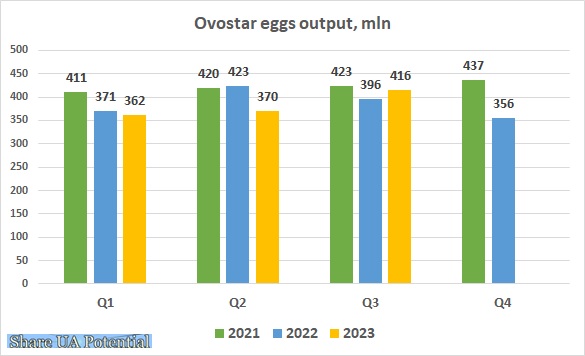

The quarterly dynamics of Ovostar egg production in recent years is shown in the graph below:

The distribution of shell egg sales between export and sales on the domestic market in the reporting quarter has changed compared to previous reporting periods.

A decrease in the export price (-40% since the beginning of 2023), as well as quite high prices for eggs on the domestic market, led to the fact that the export of shell eggs in the third quarter of 2023 was lower compared to the previous two quarters and amounted to 72 million pieces (for comparison, in the second quarter of the current year – 103 million pieces).

In general, in the reporting quarter, the average Ovostar selling price of shell eggs decreased by 22% compared to the previous quarter, and by 36% compared to the first quarter of 2023.

Due to the decrease in the prices of grain and oilseed crops in Ukraine, which affected the cost of feed and, accordingly, the cost of egg production, Ovostar's financial results in the reporting period were quite strong.

Ovostar revenue in the third quarter of 2023 was $34.4 million ($41 million in the previous quarter and $33.7 million in the third quarter of 2022). In the first nine months of 2023, the company's revenue increased by 36% compared to last year (due to the increase in the average sales price) and amounted to $123 million.

In the reporting quarter, Ovostar's EBITDA indicator almost did not change compared to the third quarter of 2022 and amounted to approximately $11 million, but for the first nine months, changes in the profitability of the company's activity are significant.

In the current year, for January-September, EBITDA of Ovostar amounted to $32 million (a year ago $6.5 million), even despite the depreciation of biological assets in the amount of $23 million (January-September 2022 - $8.7 million).

An increase or decrease in the value of biological assets is a rather subjective factor, therefore, to understand the real financial performance of the company, in our opinion, the most objective figure is the adjusted operating cash flow before changes in working capital (the adjustment should be made for the amount of investments in biological assets, which is reflected in investment cash flows).

So for the third quarter of 2023, adjusted operating cash flow made approximately $8 million compared to $17 million in the previous quarter (a decrease due to a decrease in the average selling price of eggs).

In total, Ovostar's adjusted operating cash flow for the first nine months of 2023 was approximately $48 million (compared to $10 million for the first nine months of 2022).

Due to the reduction of receivables of related companies, the total operating cash flow for January-September of the current year even exceeded the adjusted operating cash flow before changes in working capital and amounted to $67 million, of which $8.5 million was directed to investments in the replacement and expansion of stocks. I am a chicken, another $8.5 million to repay loans, and $4.2 million to pay dividends to shareholders.

As of the end of September, the amount of cash in Ovostar's balance sheet was $58 million (debt of the company stands just at $2.5 million), the company has a very strong structure and balance sheet quality.

So the main question for the future of the company is how it will use the money. The most obvious ways of their use are investments in the purchase of new assets, expansion of production (or increased vertical integration), or portion of it can be directed to dividends to shareholders.

Ovostar's shares are listed on the Warsaw Stock Exchange, but they are almost not publicly available, since 66% of the company belongs to the majority shareholders (Ukrainian businessmen Borys Belikov and Vitaly Veresenko), and another 27.5% - to the Canadian insurance group Fairfax.

In total, in the first half of 2023, Ovostar produced 732 million eggs, which is 8% less y-o-y.

The dynamics of sales of shell eggs was in accordance with the production volumes (sales in the second quarter were at the level of the previous quarter, for the first half of Y2023 sales decreased y-o-y by 12%).

The company is trying to maximize the export volume of shell eggs, in H1 2023, they increased by 62.5% y-o-y.

The average selling price of shell eggs in Q2 decreased vs. Q1 ($0.114 per piece versus $0.139), but remains significantly higher compared to H1 2022 ($0.066 per piece in the second quarter of 2022).

Significant increase of prices (which took place in the autumn of 2022) was the main factor that affected the revenue and the profitability of the company's activity during the last few quarters.

Revenue of Ovostar in the second quarter of 2023 was $41.4 million (vs. $47 million in the previous quarter and $29 million in the second quarter of 2022). In the first half of 2023, the company's turnover increased by 57% compared to last year (due to the increase in the average selling price).

We also note that due to relatively low domestic prices for grain and oilseed crops in Ukraine, the cost of feed in the current year was lower y-o-y, which, in combination with higher eggs prices, led to a significant increase in profitability of the company.

The formal EBITDA of Ovostar in the reporting period (the first half of 2023) amounted to $21.7 million (a year ago the loss made -$15.5 million), even despite the depreciation of biological assets in the amount of $23 million (the first half of 2022 - $19.2 million).

An increase or decrease in the value of biological assets is a rather subjective factor, therefore, to understand the real financial performance of the company, in our opinion, the most objective figure is the adjusted operating cash flow before changes in working capital (the adjustment should be made for the amount of investments in biological assets, which is reflected in investment cash flows).

So for the second quarter of 2023, adjusted operating cash flow was approximately $17 million compared to $23 million in the previous quarter (a decrease due to a decrease in the average selling price of eggs).

In total, for the first half of 2023, Ovostar's adjusted operating cash flow amounted to $40 million (for comparison, in the first half of 2022, this indicator was close to zero).

Due to good performance and the reduction of the receivables of related companies, the total operating cash flow for the reporting half year period amounted to $56 million, of which $5 million was directed to investments in the replacement and expansion of the chicken population, another $8.5 million - to repay loans, and $4.2 million - to pay dividends to shareholders (Ovostar shares are listed on the Warsaw Stock Exchange).

As of the end of June, the amount of cash in Ovostar's balance sheet was $50 million (while total gross debt amounted to $2.5 million, the structure and quality of the company’s balance sheet are strong).

In August, domestic prices for eggs in Ukraine decreased by another 15-20%, but their growth is expected already in autumn, so our opinion that 2023 will be absolutely the best year for Ovostar in its entire history, remains unchanged.