17 July 2023

In 2022, the Silpo network increased its turnover and had a positive operating cash flow, although the balance sheet structure remains mediocre.

Silpo-Food Company has published the official consolidated financial report as well as the management report for 2022.

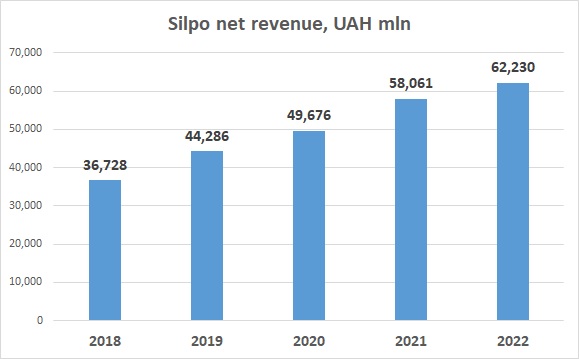

The company's total sales revenue in 2022 decreased by 4% compared to the previous year and amounted to UAH 70 billion. At the same time, the turnover from retail sales, on the contrary, increased by 7% compared to last year to UAH 62 billion.

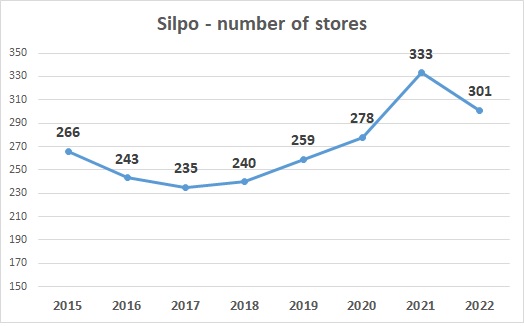

Due to the full-scale Russian invasion, the Silpo chain lost more than 30 supermarkets - 18 remained in the occupied territory, 31 supermarkets were partially or completely destroyed (of which 14 were not rebuilt). In March 2022, a rocket hit a warehouse of frozen products (losses reached UAH 542 million), the distribution center in Kharkiv was also closed due to military risks.

At the same time, eight new supermarkets were opened during the year 2022. The total number of Silpo chain stores as of December 31, 2022 decreased compared to the number at the end of 2021 - from 334 to 301, the average retail area of the chain in 2022 was close to the previous year (during 2021, the number of Silpo supermarkets increased from 278 to 333).

It means the average sales per 1 sq m of the network in 2022 showed a slight increase in nominal UAH terms, mainly due to inflation, while in real terms, sales per 1 sq m decreased by approximately 15%.

We consider these dynamics in 2022 as quite good, taking into account the hostilities in the key region for Silpo - the Kyiv region - in March, as well as the departure of a significant number of the Ukrainian population abroad. Also, this dynamic is comparable to the figures of the number one food chain in Ukraine in terms of the number of stores and the amount of revenue - ATB Market.

If we consider the profitability of Silpo's activities in 2022 from a formal point of view, the situation looks quite threatening - the company received an operating loss of UAH 1.1 billion, while its net loss made UAH 7.6 billion.

The real picture doesn't look so bad. If we look through a more detailed structure of expenses, we need to pay attention to the depreciation in the amount of UAH 4.8 billion, exchange rate differences - UAH 2.5 billion (mainly exchange rate differences on lease obligations, in 2022 the group conducted active negotiations with lessors regarding reconsideration of lease conditions), as well as losses directly related to the war (almost UAH 900 million).

Taking into account all of the above, according to our estimates, Silpo's EBITDA in 2022 was positive and amounted to UAH 3.7 billion, including lease payments (calculated in accordance with IFRS16 standard as cash flow from financial activities) - UAH 1.5 billion. The network was able to generate a positive operating cash flow (3.9 billion UAH, excluding rent payments in the amount of 2.2 billion UAH), and even invested 1.7 billion UAH in its development.

Another positive development regarding cash flows, in 2022 Silpo-Food received more than UAH 4 billion from related companies (as a repayment of receivables and an increase in payables). This cash flow was used to reduce trade payables with unrelated suppliers.

The average inventory turnover period in Silpo in 2022 was 45 days, which is quite normal figure for the network (in ATB Market - 20-25 days, but one must take into account the much wider range of goods in Silpo). The average trade payables period is about 100 days. This is much more than, for example, in ATB Market (but we do not forget that due to the cash inflow from related companies, debt to suppliers was significantly reduced in 2022).

The amount of Silpo-Food bank loans at the end of 2022 amounted to UAH 4.6 billion. This is a fairly normal indicator for the food chain, besides, 75% of these loans are loans in the national currency (no FX risk related to them). In 2022, the company partially extended and restructured its bank loans.

The overall structure of Silpo's balance sheet does not look very good, primarily due to negative equity (mainly due to losses in 2022). Typically, business development was financed through accounts payable with suppliers (which is standard practice for most food chains).

On the other hand, from an operational point of view, the business looks good - the company is generating positive operating cash flow, which is sufficient to service liabilities and further gradually develop the network.

In 2023, Silpo plans to open ten new stores, and by the end of 2025, the network plans to grow to 365 supermarkets.