April 21, 2024

Overall financial standing of Astarta remains very good, the company has good balance sheet structure and a low debt burden.

Astarta, one of the largest Ukrainian producers of sugar and milk, as well as soybean crushers, has published its financial report for the fourth quarter and the year 2023 as a whole.

EUR Mln

2021

2022

2023

Sugar output, kmt

266 282 377

Soybeans crush, kmt

172 211 232

Milk output, kmt

97 102 115

Revenue

491 510 619

EBITDA Total

201 155 145

EBITDA Sugar

36 35 39

EBITDA Agriculture

154 76 64

EBITDA Soybeans crush

5 28 28

EBITDA Milk

9 18 19

Operating cash flow

57 39 91

The total turnover of the group in 2023 amounted to 619 million euros, which is 21% more than last year's figure.

In the structure of the sales by types of products, 240 million euros were the sales in the segment of Agriculture. The turnover of the segment increased compared to last year’s figure (180.3 million euros), primarily due to active trading operations (274 thousand tons out of the total volume of grain and oilseed sales of 1 million tons, while in previous years Astarta almost exclusively sold its own production without origination from third party farmers).

The EBITDA of the Agriculture segment in 2023 made 64 million euros compared to last year's 76 million euros and 154 million euros in 2021.

The direction's profitability was largely supported by good yields of the main grain and oil crops, but sales prices showed a significant decrease (on average by 20-30% relative to 2022).

In 2023, significant changes took place in the structure of Astarta's crop rotation: corn plantation area was halved - from 38 thousand hectares to 19 thousand hectares, while at the same time the area planted under sugar beet increased from 33 thousand hectares to almost 39 thousand ha, soybeans - from 40 thousand ha to 56 thousand ha.

Season

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

2018/2019

Corn

Sown area, ha

19 100 38 000 59 000 60 580 66 780 63 470

Yield, t/ha

10.3 9.0 8.6 6.9 8.7 9.8

Soybeans

Sown area, ha

56 900 40 000 31 000 27 390 32 400 23 790

Yield, t/ha

3.1 2.9 3.0 2.3 2.5 2.9

Wheat

Sown area, ha

42 000 55 000 47 000 47 917 50 200 51 490

Yield, t/ha

5.7 4.8 5.8 4.8 5.1 4.7

Sunflower

Sown area, ha

28 200 30 000 28 000 40 450 31 040 40 350

Yield, t/ha

3.0 3.0 2.7 2.2 2.9 2.9

Sugar beet

Sown area, ha

38 900 33 000 33 000 34 500 35 255 39 435

Yield, t/ha

58 49 47 43 47 46

Total land, ha

220 000 220 000 220 000 220 000 230 000 235 000

It can be noted that sugar beet and soy were among the most profitable crops for Ukrainian farmers in the 2023/24 season, so the increase in the area under these crops also contributed to Astarta's profitability in 2023.

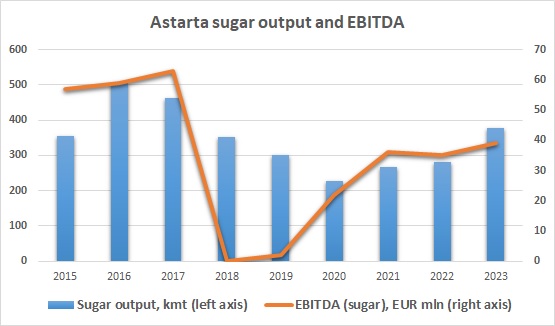

In the segment of sugar production, at the end of the year the situation slightly worsened compared to previous periods - the company's average selling price of sugar in the last quarter of the year was about 622 euros per 1 ton compared to, for example, 671 euros per 1 ton in the third quarter, which led to a decrease in the segment’s EBITDA to 4.6 million euros vs. 10.5 million euros in the previous quarter with more or less flat sales volumes.

Despite the deterioration of profitability indicators at the end of the year, the total EBITDA of the direction in 2023 increased compared to the previous year by 4 million euros and amounted to 39 million euros (with a 26% increase in sugar sales). EBITDA of the sugar production segment has become the largest for the company since 2017:

The share of exports in the total volume of sugar sales by Astarta in 2023 was about 17%, the share of Astarta in Ukrainian sugar exports is about 10-12%.

Taking into account the current situation on the Ukrainian sugar market (increase in production in 2023 to 1.8 million tons compared to last year's 1.3 million tons, as well as existing restrictions on sugar exports to EU countries), in order for the financial results of the segment to continue to remain at a good level, it is necessary that Astarta itself (as well as other major Ukrainian sugar producers) actively export sugar outside the EU in the coming months.

In this case, Ukraine will be able to realize its export potential to a large extent, which, in turn, will support domestic sugar prices in Ukraine.

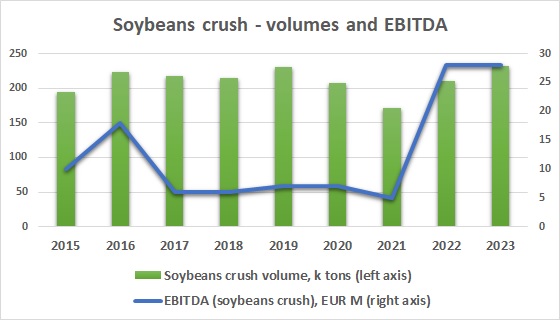

The situation in the soybean processing segment was roughly similar to the sugar sector. The profitability of processing in the last quarter of the year decreased compared to previous periods (EBITDA per 1 ton of processed soybeans was 91 euros, compared to an average of 132 euros in the first nine months of the year), but this did not prevent Astarta to achieve annual results pretty close to record year 2022.

EBITDA of the soybean crush segment in 2023 made 28 million euros, compared to 27.7 million euros in 2022 (processing volumes increased from 211 thousand tons to 232 thousand tons).

The results of the milk production segment was also quite close to last year’s – EBITDA made 18.7 million euros (18.1 million euros in 2022 and 8.8 million euros in 2021). The company continues to grow both in volume (milk production was 115,000 tons vs. 102,000 tons in 2022, the number of dairy herds also increased) and efficiency (average milk yield was 25.8 kg per day in 2023 compared to 23.6 kg in 2022).

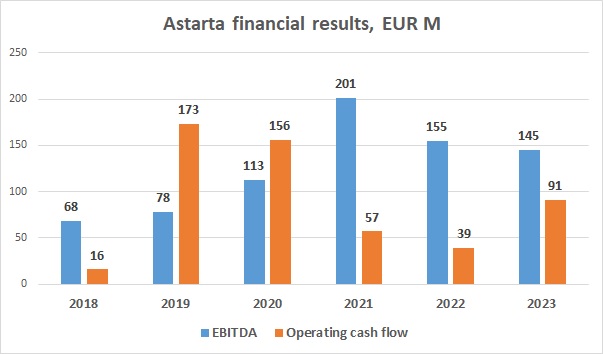

Taking into account the results of all business segments, the total EBITDA of Astarta in 2023 comprised EUR 145 million (EUR 155 million in 2022), net profit – EUR 62 million (EUR 65 million), operating cash flow – EUR 91 million (39 million euros).

Operating cash flow was directed to land lease payments (EUR 32 million), repayment of bank loans (EUR 14 million), dividends to shareholders (EUR 12 million) and investments (EUR 40 million). In 2023, Astarta started work on a new project for the construction of facilities for the deep processing of soybeans and the production of soybean concentrate.

The structure and quality of the company's balance sheet remain at a good level. Astarta bank debt as of December 31, 2023 was EUR 52 million (EUR 69 million as of December 31, 2022) with cash balance at EUR 13 million (EUR 26 million).

The overall financial standing of Astarte remains quite acceptable.