May 26, 2024

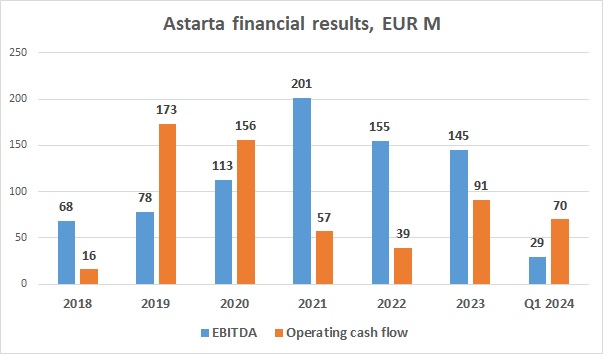

Despite the decrease in the profitability of some key segments, the overall Astarta financial results are quite good.

Astarta, one of the largest Ukrainian producers of sugar and milk, as well as soybean processors, has published its financial report for the first quarter of 2024.

EUR M

2022

2023

Q1 2023

Q1 2024

Sugar output, kmt

282 377

Soybean crush, kmt

211 232 60 61

Milk output, kmt

102 115 30 32

Revenue

510 619 164 166

EBITDA Total

155 145 38 29

EBITDA Sugar

35 39 12 4

EBITDA Agriculture

76 64 11 12

EBITDA Soybean crush

28 28 10 7

EBITDA Milk

18 19 5 6

Operating cash flow

39 91 45 70

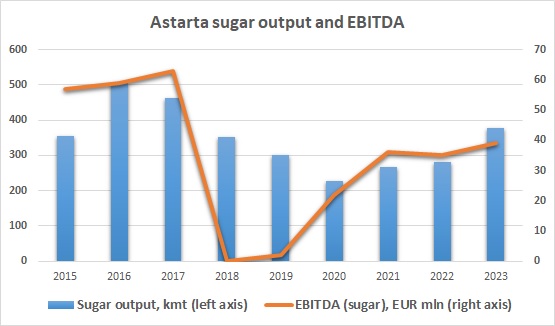

Sugar

The volume of sugar sales by the company in the first quarter of 2024 made almost 70 thousand tons vs. 50.8 thousand tons in the corresponding period of 2023 and 81 thousand tons in the previous quarter.

A negative factor was the further decrease in the sale price of sugar, which is connected with the general dynamics of world prices. In the first quarter of 2024, Astarta's average selling price for sugar was ˆ598 per 1 ton, compared to around ˆ620 in the previous quarter and ˆ669 a year ago.

Since the last quarter of 2023, logistics costs related to the sale of sugar have increased significantly (in the reporting quarter they amounted to 6.9 million euros against only 1.5 million euros a year ago).

Accordingly, EBITDA per 1t of sold sugar in the first quarter of 2024 was approximately 60 euros (in the first quarter of 2023 – more than 200 euros). The segment's total EBITDA was 4.1 million euros (11.7 million euros a year ago). Currently, the segment's profitability is at the lowest level in the last three years.

Ukrainian producers are also to face significant restrictions on sugar exports to EU countries (during 2022 and 2023 Ukraine exported sugar factually only to the EU), so having a significant surplus of production over domestic consumption in 2023, Ukrainian producers tried (and not without success) to maximize exports in the first months of 2024, and (including Astarta) began exporting sugar through deep-water Ukrainian ports to countries in Africa and Asia.

Considering that in 2024 the surplus of sugar production over domestics consumption in Ukraine is expected to happen again, in our opinion, there are quite serious risks for this segment in terms of further decrease in profitability.

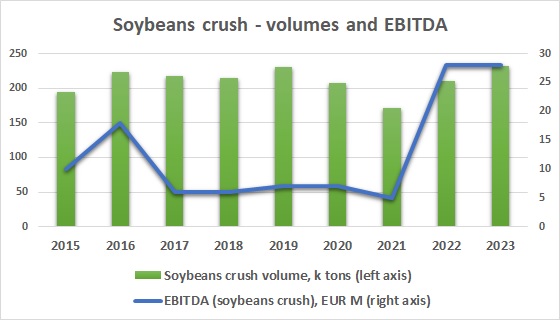

Processing of soybeans

EBITDA of the soybean processing division also decreased - from last year's 10.2 million euros to 7.1 million euros. The EBITDA margin was 24%, which is lower than in the first quarter of 2023 (33%), but higher than in the second half of 2023, so the current result can definitely be considered as quite positive.

The direction's profitability is supported by the increase in soybean acreage in Ukraine (Astarta itself is increasing soybean acreage from last year's 55,000 ha to 70,000 ha), but we can expect an increase in competition between processors and exporters in the new season as well, so the crush margins in the new season may also decrease and be closer to the historical levels (after abnormal years of 2022 and 2023):

Milk

The results in milk production and agricultural production and trade segments were quite good.

In the milk production segment in the reporting quarter, EBITDA amounted to 5.8 million euros compared to last year's 5.1 million euros (with almost no revaluation of biological assets in the current quarter and 1 million euros of revaluation a year ago). Milk production itself increased by 2,000 tons to 32,000 tons compared to the corresponding figure of the previous year, the average sales price increased from 350 euros per 1 ton to 404 euros per 1 ton.

In general, during the last years, this segment shows quite good and stable results (besides being an important part in the vertical integration of the holding).

Agriculture production and grain trading

As for the direction of Agricultural production and grain trading, its EBITDA in the reporting quarter was also quite good at 12.1 million euros (a year ago - 10.5 million euros, for 2023 in general - 63 million euros, primarily due to the revaluation of biological assets - harvest of 2023 - in the amount of 52 million euros).

The company does not separately disclose the results of grain trading operations, but in our opinion, the main factors of the good results of the segment in 2023 and the beginning of 2024 (despite the significant decrease in world grain prices during 2023) was a rather successful crop mix in Y2023 with a bet on soybeans, rapeseed and sugar beet, which became the most profitable for Ukrainian farmers in 2023.

On the other hand, the company reduced corn planting area from 38,000 hectares in 2022 to 19,000 hectares in 2023. Moreover, in 2024, Astarta's corn acreage will amount to only 6,000 tons.

The historical distribution of acreage and yield of Astarte is shown in the table below:

Season

2024/2025

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

Corn

Sown area, ha

6 000 19 100 38 000 59 000 60 580 66 780

Yield, t/ha

10.3 9.0 8.6 6.9 8.7

Soybean

Sown area, ha

70 000 56 900 40 000 31 000 27 390 32 400

Yield, t/ha

3.1 2.9 3.0 2.3 2.5

Wheat

Sown area, ha

49 000 42 000 55 000 47 000 47 917 50 200

Yield, t/ha

5.7 4.8 5.8 4.8 5.1

Sunflower

Sown area, ha

18 000 28 200 30 000 28 000 40 450 31 040

Yield, t/ha

3.0 3.0 2.7 2.2 2.9

Sugar beet

Sown area, ha

38 000 38 900 33 000 33 000 34 500 35 255

Yield, t/ha

58 49 47 43 47

Total land, ha

220 000 220 000 220 000 220 000 220 000 230 000

Summarizing the results of all segments, Astarta's EBITDA in the first quarter of 2024 amounted to EUR 28.6 million (a year ago – EUR 37.0 million). Despite the decrease compared to last year's figure, we consider the current result to be very good.

Due to current profits and the reduction of the company's inventory stock, in the reporting quarter Astarta generated a positive operating cash flow in the amount of almost EUR 70 million (a year ago – EUR 45 million).

Part of the cash flow was directed to the payment of land lease obligations (12 million euros) and repayment of bank loans (8 million euros). At the same time, the amount of cash in the balance sheet increased from 13 million euros at the end of 2023 to 56 million euros.

According to our expectations, part of these funds in the following quarters will be used to finance working capital needs in the new production season. We also expect the company to pay dividends based on results in 2023. The expected amount of dividends is 12.5 million euros, the decision will be taken by the general meeting of the company's shareholders, which will be held on June 4.

Given the good structure of Astarta's balance sheet (the company finances its assets mainly with its own capital, the company's debt as of March 31 was only EUR 45 million with cash of EUR 56 million and inventories of EUR 206 million), the company can afford to pay dividends, as well as make new investments.