29 December 2023

Astarta and Ukrainian state-owned Oschedbank signed investment loan agreement for $60 mln.

Astarta, one of the largest Ukrainian producers of sugar and milk, as well as soybean crushers, signed new investment loan agreement for the total amount of $60 mln with Ukrainian state-owned bank Oschadbank.

Tenor of new loan is to make seven years. The funds raised will be used to finance an investment project to build a new soybean processing plant in Globyno (the Poltava region) which will produce soybean protein concentrate.

Expected annual soybeans concentrate output is to make 100kmt.

Initially this investment project was considered by management of Astarta before Russian full-scale invasion to Ukraine, but it was postponed.

In our view, the company can well afford investments into new projects, as the quality of its balance sheet remains close to excellent.

Astarta's total debt (excluding lease obligations) as of the end of September 2023 was EUR 51 million with cash and cash equivalents of EUR 27 million and inventories with a book value of EUR 223 million (an additional EUR 92 million are current biological assets - mainly sugar beet and corn crops in field).

The company finances its activities mainly with its own funds, the book value of equity as of September 30 was EUR 539 million, the current (as of December 28) capitalization of the holding is $184 million.

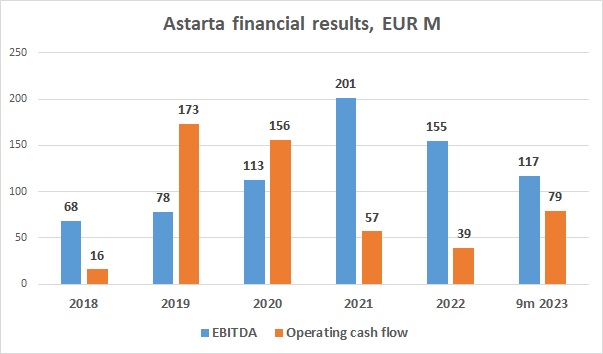

For January-September 2023, Astarta's EBITDA amounted to EUR 117 million (EBITDA adjusted on lease payments – EUR 90 million), net profit – EUR 56 million. Despite the war, during last reporting periods Astarta remained profitable and showed good performance.