2 January 2024

In total during January-September 2023 Interpipe EBITDA made $287 mln, net income - $189 mln.

Interpipe has released its financial report for the third quarter and the first nine months of 2023.

Q3 2023

9m 2022

9m 2023

Revenues, $mln

267 687 785

EBITDA, $mln

111 123 287

Operating cash flow, $mln

128 105 224

According to the company's report, its turnover for January-September 2023 amounted to $785 million, which is 14% higher y-o-y.

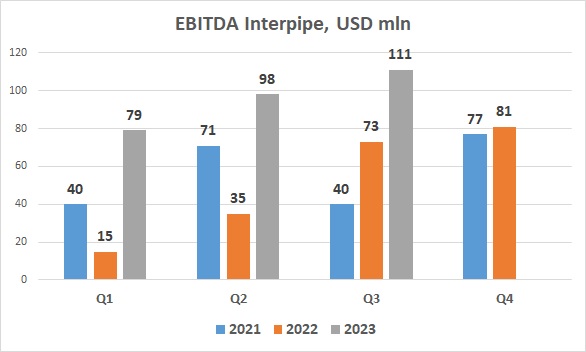

The group's EBITDA for the same period amounted to $287 million, which is more than twice as high as for the corresponding period in 2022 ($123 million). In Q3 2023 alone EBITDA amounted to $111 million, which is the best figure for the recent years.

According to the Interpipe report, the main driver of profitability growth was the segment of pipes production (for the nine months of 2023, the EBITDA of this segment was $158 million compared to $52 million a year ago). At the same time, other directions are also quite profitable - the production of steel and railway wheel products.

The increase in profitability resulted from severl factors. First of all - favorable market conditions, then the group's efforts to produce new types of products that are in demand on the European and American markets, as well as increase in drilling activity in Ukraine (to boost natural gas output), and last but not least - low domestic prices for scrap metal in Ukraine.

In the cost structure of production, scrap metal currently accounts for about 35%, another 14% - ferroalloys and other materials, 26% - energy carriers.

The company's operating cash flow in the reporting quarter amounted to $128 million, for the first nine months of 2023 in total - $224 million.

Regarding the usage of cash inflows, in the first half of the year Interpipe issued a loan to companies related to the shareholder (Viktor Pinchuk) in the amount of $85 million (the interest rate on the loan is 9%).

During the reporting quarter, the high value of the company's operating cash flow led to a significant increase in the amount of money in Interpipe's accounts - from $159 million as of June 30 up to $276 million.

After the restructuring and write-off of a significant part of the company's debt carried out in 2019, the total debt burden of Interpipe decreased significantly, as of September 30, 2023, the total amount of debt was $429 million (the main part - $300 million of Eurobonds - should be repaid in 2026).

So the overall financial standing of Interpipe remains quite acceptable, the company continues to generate substantial cash flows and has a stable liquidity position.