24 December 2023

But due to the closed Black Sea deep-sea ports during most of the reporting quarter, the overall financial performance of the Kernel group during July-September 2023 worsened.

Key operating and financial performance figures of the Kernel group for the first quarter of the financial year 2024 (July-September 2023):

Q1 FY2023

Q1 FY2024

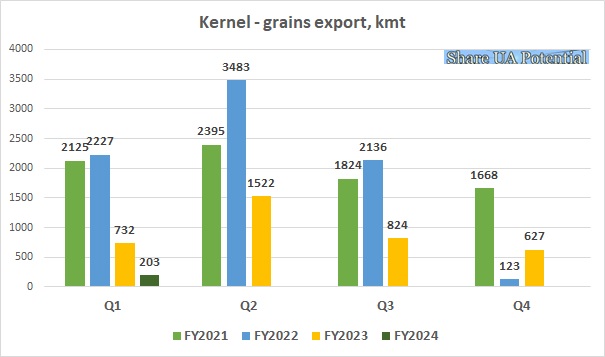

Grains export, kmt

732

203

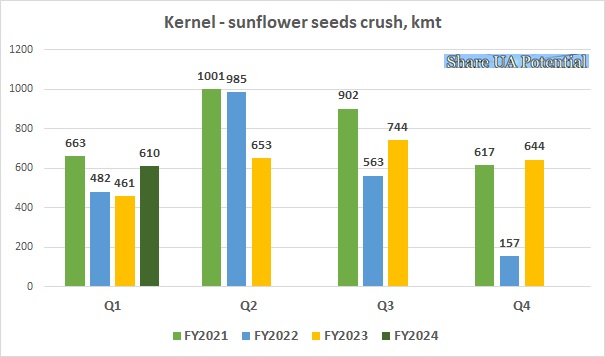

Oilseeds crush, kmt

461

644

Oil sales, kmt

202

369

Revenue, $ mln

655

546

Total EBITDA, $ mln

168

19

EBITDA oilseeds crush, $ mln

45

58

EBITDA Trading, $ mln

60

6

EBITDA Farming, $ mln

81

-23

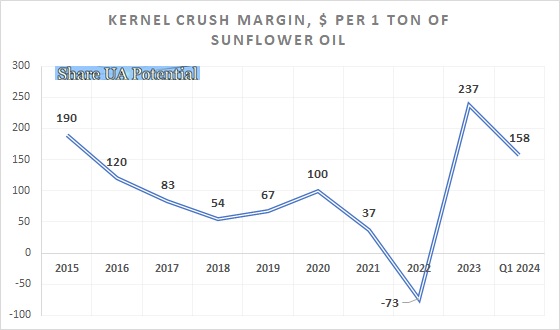

In the reporting quarter, the best operating and financial performance was in oilseeds crush business segment of Kernel.

The total volume of oilseeds processing was 610,000 tons, which was relatively flat q-o-q, but much higher y-o-y (in Q1 2023 volume of oilseeds crush made 461,000 tons). It is interesting that in the reporting period Kernel processed 112,000 tons of rapeseed (such a volume was achieved for the first time in last years).

EBITDA of Kernel's oilseeds processing segment in Q1 FY2024 made $58 million, vs. $45 million in Q1 FY2023 (also for comparison, for the entire pre-war financial year 2021, Kernel earned $51 million in this segment).

According to ShareUAPotential expectations, due to the competition among crushers and the low profitability of Ukrainian farmers in the current season, which encourages them to delay the sale of the crop at current prices, after the growth in September-October, the margin of the segment is to gradually decrease.

In other business segments, Kernel's results are significantly worse compared to oilseeds processing.

As for the grains trading and infrastructure segment, due to the closure of Ukrainian Black Sea ports in July 2023, the volume of grain exports by the company in the reporting period significantly decreased compared to previous periods and amounted to only about 200,000 tons (mainly through the ports of the Danube and Romanian Constanta).

The financial results of the segment were close to zero (EBITDA made $6 million vs. $60 million a year ago). According to our expectations, with the resumption of Ukrainian grain exports through deep-sea Black Sea ports since September-October, the financial results of the direction will improve significantly already in the next reporting period.

The worst results among all the main segments in the reporting period were in the Farming segment. Due to the revaluation of commodity stocks and crops in fields, due to a significant decrease in domestic prices for grain and oilseeds in Ukraine (after the drop of global prices and because of high logistics costs associated with the export of goods by alternative routes), Kernel's EBITDA was negative and amounted to -$23 million.

On the other hand, it should be noted that despite significant savings and reduction of costs related to grains growing, due to favorable weather conditions, in the current year the company achieved near-record yields of the main crops.

Season

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

2018/2019

Corn

Sown area, ha

84 400 150 000 255 000 255 000 231 000 222 000

Yield, t/ha

10.2 8.8 9.3 8.0 8.5 9.8

Wheat

Sown area, ha

61 100 35 000 64 000 73 000 97 000 100 000

Yield, t/ha

6.7 4.5 6.1 4.9 5.9 5.1

Sunflower

Sown area, ha

119 800 130 600 154 000 149 000 137 000 132 000

Yield, t/ha

2.8 2.5 3.0 3.0 3.5 3.2

Total land, ha

363 000 363 000 500 000 510 000 514 000 550 000

Due to high crop yields, as well as the gradual increase in domestic prices for grains and oilseeds already after the opening of exports through deep-sea ports, we expect that Kernel's Farming segment in FY2024 will be profitable (although the profitability figures will be far from those of the years before the full-scale Russian invasion).

Kernel's total EBITDA in the reporting period made $19 million, net loss comprised $31 million, operating cash flow before changes in working capital was positive and amounted to $53 million. According to our estimates, the group's results will improve already in the next quarter.

The main changes in the company's balance sheet during the reporting period relate to a seasonal increase in inventory (by $146 million), a decrease in VAT receivables (about $80 million), as well as the company's investment activities.

As for the latter, in the reporting period the company spent $72 million on the construction of an oilseeds processing plant in Starokostyantyniv, as well as the purchase of new assets for the storage and transshipment of grain and oil.

Also Kernel received from companies related to its main shareholder Andriy Verevsky, the last tranche of payment for the group's assets sold in the first half of 2022 (as per Kernel - in order to improve the company's liquidity). The amount of the tranche was $91 million.

Additionally, the company received $54 million from the issuance of new shares (due to which the share of Kernel's minority shareholders was diluted, minority shareholders plan to challenge similar actions of the company's management in court). The company emphasizes that this issuance was carried out at the request of creditors as part of the restructuring of the credit portfolio.

As of September 30, 2023, Kernel's total debt is $1.45 billion, with cash of nearly $1.1 billion, and inventory (including the book value of crops) of nearly $600 million.

The overall financial condition of the company, in our opinion, remains quite acceptable.