March 6, 2024

Thanks to the resumption of exports through Ukrainian deep-sea ports, during October-December 2023, Kernel significantly improved its operational and financial performance.

Kernel released its financial report for the second quarter of FY2024 (October-December 2023).

The main operating and financial performance figures of the group during the reporting period were as follows:

Q2 FY2023

Q1 FY2024

Q2 FY2024

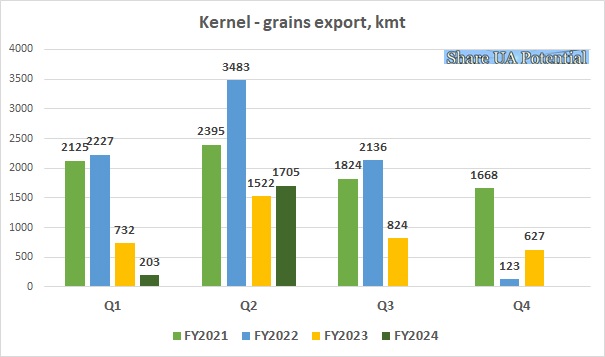

Grains export, kmt

1522

203

1705

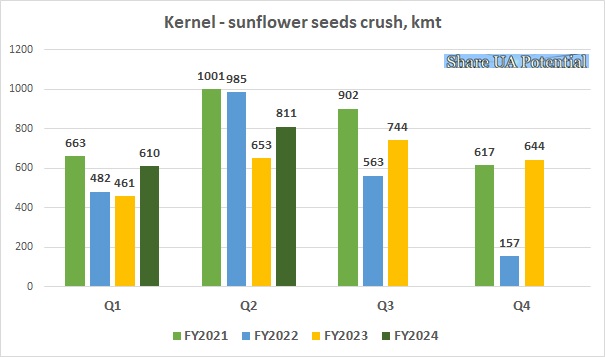

Oilseeds crush, kmt

653

610

811

Oil sales, kmt

345

369

388

Revenues, $m

1235

546

1044

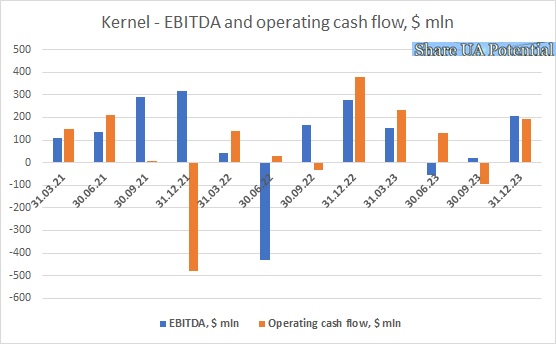

EBITDA, $m

278

19

205

EBITDA Farming, $m

204

-23

103

EBITDA Oilseeds crush, $m

66

58

76

EBITDA Trading&Infrastructure, $m

62

6

37

Operating cash flow, $m

379

-95

192

In the oilseeds crush segment, operating and financial performance remains very strong.

In the reporting quarter, Kernel processed 811,000 tons of oilseeds, which was the largest figure since the beginning of the full-scale Russian invasion to Ukraine in February 2022.

The volume of sunflower oil sales in the reporting quarter was 388,000 tons, 5% more than in the previous quarter and 13% higher y-o-y.

EBITDA of the segment made $76 million (taking into account $7 million of profit from the production of alternative types of energy from waste from oilseeds processing, as well as insurance compensation for assets damaged as a result of hostilities), compared to $58 million in the previous quarter.

In general, the profitability of oilseeds crush remains quite high against the background of a good sunflower harvest in Ukraine in 2023, as well as exports logistic constraints at the beginning of the current season.

Additionally, the sunseeds harvest-pressure period is historically the most profitable period of year for crushers, so Kernel expects the segment's profitability to decline in the second half of the season.

With the re-opening of exports through the deep-sea ports of Ukraine in September-October 2023, the situation with grain exports has also improved significantly. The volume of exports in the reporting quarter amounted to more than 1.7 million tons, which is also the highest figure since the beginning of the full-scale invasion.

For comparison, during October-December 2022, Kernel exported 1,522 million tons of grain, in July-September of the current year (when exports through deep-sea ports was blocked) - only 203,000 tons.

The financial results of the segment also significantly improved compared to the previous quarter, although they slightly worsened compared to last year’s.

The direction's EBITDA made $37 million ($6 million in the previous quarter and $62 million in October-December 2022, when the profitability of exporters' operations was extraordinary high, which was connected with opening of the grain corridor from Ukrainian deep-sea ports after half-year blockade).

The results in the Farming segment improved significantly.

Evaluating current results, in our opinion, it is worth to start with the fact that in previous reporting periods the company was quite conservative in estimating the book value of its crop stock and future harvest (EBITDA of the segment in the first quarter of the current financial year was -$23 million).

As a result of re-opening of Ukrainian ports in October’23, the domestic grains prices in Ukraine recovered somewhat from the decline (due to global grains prices drop since the beginning of Y2023), though prices are still much lower even compared to last year’s.

It should also be noted that in the current year, Kernel received a near-record yield of the main grain and oilseed crops. The company's wheat yield in 2023 was 6.6 t/ha, sunflower and soybean - 2.9 t/ha, corn - 10.1 t/ha.

Due to these factors, as well as the significant volume of grain sales of the company's own harvest in the reporting period, segment’s EBITDA in October-December 2023 amounted to $103 million.

Thanks to the rather strong results of each of the business segments, Kernel's total EBITDA in the reporting quarter made $205 million, operating cash flow before changes in working capital - $225 million, net operating cash flow - $192 million.

$40 million of earned cash was directed to investment activities (including the purchase of the third vessel for the group), the rest - to the repayment of bank loans.

In total, the group paid more than $600 million in debt to creditors during October-December. The main sources of payment were, in addition to operating cash flow, cash available at the beginning of the reporting period. As a result the total amount of cash decreased from $1.056 billion as of September 30 to $565 million as of December 31.

As for Kernel's current balance sheet structure, it looks pretty good. Financial debt as of the reporting date amounted to $820 million (the main components are Eurobonds in the amount of $597 million due in the fall of 2024, as well as loans from the EBRD and the EIB). Against those liabilities current assets included $565 million in cash and $539 million in inventory.

The general financial standing of the company, in our opinion, remains quite acceptable, but the main risks relate to the possibility of exporting of grain and oilseed crops through Ukrainian deep-sea ports.