March 23, 2024

Metinvest revenue in 2023 decreased by 11% compared to the previous year and amounted to $7.4 billion.

2022

2023

Crude steel output, kmt

2918

2025

Iron ore output, kmt

10712

11092

Coal output, kmt

4959

5455

Revenue, $M

8288

7397

Total EBITDA, $M

1873

861

EBITDA Metallurgy, $M

267

159

EBITDA Mining, $M

1547

770

Cash, $M

349

646

Metinvest group published a press release and a presentation with the main indicators of the group's financial report for Y2023.

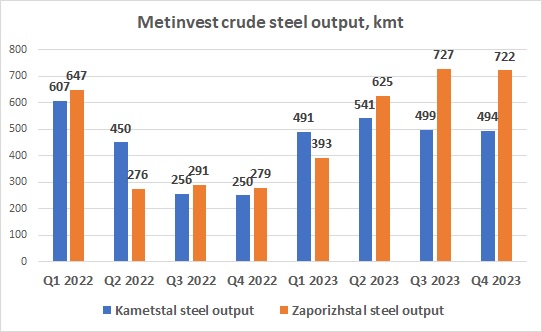

In recent months, the group has stabilized production at its main metallurgical assets (Kametstal, as well as Zaporizhstal, in which Metinvest owns a 50% stake, and the results of which are not consolidated in the group's official statements).

The dynamics of steel output at Kametstal and Zaporizhstal during the last reporting quarters is shown in the following graph:

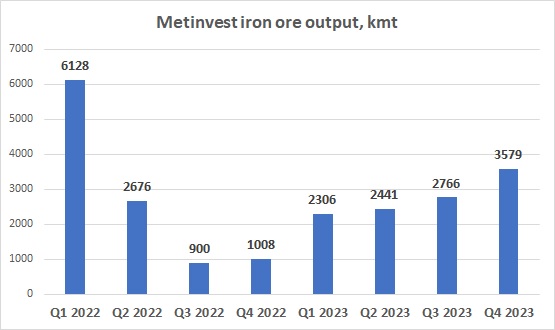

As for the production of iron ore, the group is gradually increasing ore output, which is primarily the result of the opening of the opportunity to export products through the deep-sea ports of Ukraine, starting from October-November 2023. As a result, in the last quarter of the year, the total output of iron ore concentrate by Metinvest amounted to 3.6 million tons, compared to an average of 2.5 million tons in the previous quarters.

The total revenue of Metinvest in 2023 amounted to $7.4 billion, which is 11% lower y-o-y. The reasons for the decrease are: 1) in January-February 2022, the group's Mariupol plants were still operating; 2) the average selling price of the main types of products in 2023 was significantly lower compared to the previous year.

Sales of metallurgical products of the group in the reporting year decreased by 15% compared to last year to $4.8 billion, but sales of the mining division remained almost unchanged compared to 2022 and amounted to $2.6 billion.

It can be expected that with the opening of exports through the Black Sea ports of Ukraine, iron ore sales will increase significantly in the first half of 2024, while metallurgical production remains relatively stable (Kametstal and Zaporizhstal were already working at 65-75% of their total capacity in the second half of 2023).

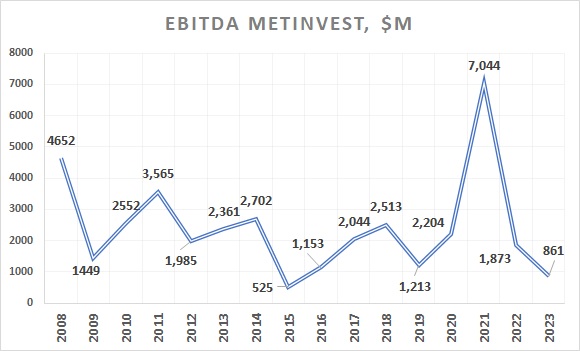

Regarding the profitability of the segments in 2023, EBITDA of the metallurgical division was $159 million, mining division - $770 million. It is the latter that remains the main center of profitability of the group. We expect the situation to remain similar in 2024, but a big risk for the group could be the risk of a decline in the global price of iron ore, which could happen in the event of a significant slowdown of the Chinese economy.

The total EBITDA of the group in 2023 amounted to $861 million (in 2022 - primarily due to higher prices for ore and metal - $1.873 billion).

Operating cash flow of Metinvest in 2023 amounted to $707 million and was directed to investment activities ($305 million, mailny maintenance capex), as well as debt repayment ($125 million). The amount of cash in the company's accounts during 2023 increased from $349 million to $646 million.

The total amount of Metinvest's debt as of December 31, 2023 was $2 billion, in 2024 the company must repay only $52 million, the main debt repayments will take place starting in 2026 (so Metinvest currently has a pretty good situation with overall liquidity).

Regarding the future prospects of the company, the main positive factor was the opening of Ukrainian deep-sea ports for the export of ore and metallurgical products. There are enough risks - both related to the war and price risks, primarily related to the situation in the Chinese economy.