19 November 2023

Thanks to its vertically integrated structure and stable poultry exports, MHP's financial performance in the third quarter of 2023 was quite stable.

$ mln

Q3 2023

Q2 2023

Q1 2023

Q3 2022

Poultry sales, kmt

178

174

188

174

Average poultry price, $/kg

1.96

1.97

1.85

2.03

Vegetable oil sales, kmt

138

169

77

103

Revenues

739

809

746

727

EBITDA

111

101

117

121

Operating cash flow

121

178

96

123

The largest producer of poultry meat in Ukraine - the MHP company - published its financial report for the third quarter and the first nine months of 2023.

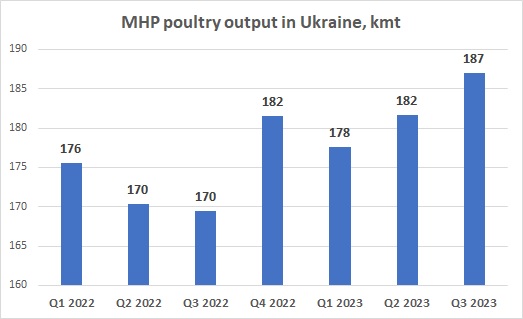

In poultry segment capacity utilization of MHP is close to 100%, in the reporting quarter, the company's total production of poultry meat amounted to 187 thousand tons, which is 3% higher q-o-q, and 10% higher y-o-y, and is the largest output volume for several recent reporting quarters:

For the period of January-September 2023, MHP poultry output in Ukraine made 546 thousand tons, compared to last year's 515.5 thousand tons.

Sales of poultry meat in the reporting quarter were stable compared to previous reporting periods, for the nine months of 2023, the total volume of sales was 535 thousand tons (+13% compared to the corresponding period of 2022).

The share of exports was 56% of the total volume, y-o-y growth of sales in 2023 was mainly achieved due to exports dynamucs (+21%), at the same time, sales volumes on the domestic market were relatively stable.

Although the average export price decreased compared to the previous year (in the third quarter of 2023 - $2.17 per 1 kg compared to $2.49 per 1 kg a year ago), we can note that despite the significant decrease in world prices for grains and oilseeds in recent months, the decrease of poultry prices slowed down. Accordingly, compared to the previous quarters of 2023, the average price of poultry exports has barely changed.

The average poultry sale price on the domestic market is gradually increasing. During the reporting quarter, it increased by 20% compared to last year's, vs. previous quarter – by 6%. At the same time, the average sales price on the domestic market (without taking into account additional logistics costs) remains significantly lower compared to the export price ($1.70 per 1 kg versus $2.17 per 1 kg).

The third quarter of 2023 was the first reporting period for MHP when the company reported separate results for poultry segment and oilseeds processing segment. Accordingly, in the poultry segment (in Ukraine) in the reporting quarter, MHP earned EBITDA at the level of $83 million. This is less than in the previous quarter ($100 million), but more than in the corresponding period of 2022 ($53 million).

In total, for January-September 2023, the earnings of this segment of the company amounted to $261 million or almost $0.5 per 1 kg of sold meat.

In the oil processing segment, the total sales volumes of sunflower oil in the reporting quarter decreased slightly compared to the previous one (127 thousand tons and 169 thousand tons, respectively), which is explained by the decrease in sunflower seeds stocks in Ukraine in the last months of the 2022/23 season.

EBITDA of the segment in the third quarter amounted to $23 million ($167 per 1 ton of sunflower and soybean oil sold), in total for January-September 2023 - $72 million.

In the Grain growing segment, the MHP performance is similar to other Ukrainian agricultural holdings (for example, see the analysis of the financial reports of Astarta and IMC by ShareUAPotential).

Yield of the main crops are significantly higher compared to the previous year and, in general, are close to record levels:

Yield, t/ha

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

Corn

9.8 7.2 10.0 5.6 9.4

Wheat

6.6 5.5 5.9 5.1 6.4

Sunflower

3.1 2.5 3.2 2.8 3.6

Rapeseeds

3.7 3.8 3.3 2.6 3.0

Soybeans

3.1 2.4 2.5 2.3 2.7

At the same time, due to the decrease in world prices for grains and oilseeds this year, as well as high logistics costs for the export of Ukrainian agricultural products, the financial performace of the segment was not very optimistic. In the reporting quarter, the segment's EBITDA was close to zero, for the first nine months of the year, the loss amounted to -$32 million.

The financial results of the Grains growing segment (and especially their distribution between different reporting periods) are affected by the revaluation of biological assets (crops in fields).

In 2022, MHP was quite aggressive in revaluating of its biological assets and 2022 harvest (according to the financial report for 2022, EBITDA per 1 ha was $273, probably including currency revaluation gains). In addition, the yield of late MHP crops in 2022 was quite low (corn yield – 7.2 t/ha versus 10 t/ha in 2021).

So after harvesting and selling grain, the company could not confirm the profit, which was unrealized until the time of sale.

In 2023, according to the company's data, the revaluation of crops was less aggressive compared to last year, on the other hand, a much better yields of crops are expected, but the current prices are also significantly lower compared to the previous year.

It should also be taken into account that a significant part of the MHP crop is processed by the company itself into feed for chickens, so in general MHP much more depends on the dynamics of prices for chicken than for grains and oilseeds.

The European segment of MHP - Slovenian Perutnina Ptuj - has been showing quite good financial results. In the first nine months of 2023, the company's sales in volume terms increased by 9% compared to last year, revenue - by 19% (up to $411 million), EBITDA amounted to $68 million.

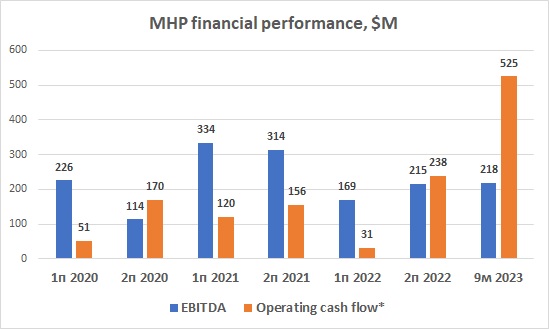

Summarizing all of the above information, we note that in the reporting quarter, MHP's total adjusted EBITDA amounted to $111 million, operating cash flow before changes in working capital - $109 million, total operating cash flow - $121 million.

In the first nine months of 2023, MHP's adjusted EBITDA amounted to $329 million (a year ago - $275 million), operating cash flow - $395 million. The funds were directed to investment activities ($156 million, mainly to maintenance, development of MHP as a culinary company and to increase production volumes at Perutnina Ptuj). In parallel, the company reduced the debt burden ($72 million). In addition, the amount of funds in the company's accounts increased from $300 million at the beginning of the year to $446 million.

In general, the debt burden of MHP remains significant - the total amount of debt as of September 30, 2023 (excluding land lease obligations) amounted to more than $1.6 billion. Of this amount, about $1 billion is long-term debt, the rest is short-term, mainly bonds with repayment in May 2024 ($500 million).

Maturity of the bonds in 2024 looked like the biggest risk for the company in the short term, so definitely positive news for MHP is the opening of new credit lines from EBRD, IFC and DFC for a total of $480 million to refinance bonds. In October, the company announced a tender for the purchase of its own bonds maturing in 2024 with a discount of 15%.

According to the results of the tender, in November MHP bought bonds worth $150 million for $128 million, of which $107 was raised from the above-mentioned creditors. The rest of bonds ($350 mln) is to be repaid in Y2024.

It can be concluded that MHP is close to solving its biggest issue related to the company's liquidity, which significantly increases its financial stability in the medium term.