May 17, 2024

Financial standing of MHP remains quite stable, its operating and financial results for the reporting year were good, but the debt burden remains significant.

MHP company published its financial report for the fourth quarter and the entire year 2023.

$M

Q4 2023

Q4 2022

2023

2022

Poultry sales*, kmt

157

184

692

658

Poultry price, $/kg

1.98

1.90

1.95

1.95

Vegetable oil sales, kmt

106

109

518

314

Revenue

727

766

3021

2642

EBITDA

116

109

445

384

Operating cash flow

43

8

438

138

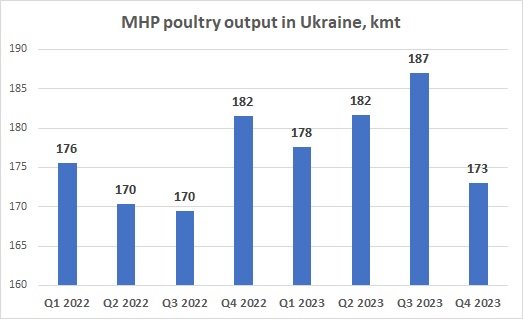

Despite a slight decrease in the output of poultry meat in the last quarter of the year (172.3 thousand tons, -8% compared to the previous quarter and -5% compared to the corresponding period of 2022), in general, in 2023, the volume of chicken production of the MHP in Ukraine increased y-o-y by 3% and amounted to 718.6 thousand tons.

Sales in the chicken production segment were similar to the production dynamics - in the last quarter of the year (primarily due to a decrease in exports), they decreased by 15% y-o-y, but in Y2023 as a whole, they increased by 5% to 692 thousand tons (export increased by 8% and amounted to 397 thousand tons - or 57% of the total sales volume).

Revenue of the Poultry segment in 2023 made $1,643 million (+8% vs. 2022), adjusted EBITDA made $321 million (in 2022 - $204 million), while the profitability of the direction gradually decreased during 2023. If in the second quarter the EBITDA margin of the direction was 24%, in the fourth quarter it was already 16%.

In the oilseeds processing segment, profitability also decreased significantly at the end of 2023 - to about $44 per 1t of processed sunflower in the fourth quarter, compared to $78 per 1t in the previous quarter. In total, in 2023, EBITDA of the direction amounted to $82 million with a total sales volume of 467,000 tons of sunflower oil (273,000 tons in 2022) and 51,000 tons of soybean oil (41,000 tons).

The volume of sales of sunflower oil in 2023 became the largest in the entire history of the company.

During 2022-2023, the profitability of oilseeds processing in Ukraine reached all-time record levels, but, in our opinion, it will significantly decrease already in 2024.

The last quarter of 2023 turned out to be relatively good for MHP in terms of operating and financial results of Grains Growing segment. Firstly, the company significantly increased the yield of the main crops compared to the previous year (the yield of corn was 9.9 t/ha, wheat – 6.6 t/ha, sunflower – 3.1 t/ha).

Yield, t/ha

2023/2024

2022/2023

2021/2022

2020/2021

2019/2020

Corn

9.9 7.2 10.0 5.6 9.4

Wheat

6.6 5.5 5.9 5.1 6.4

Sunflower

3.1 2.5 3.2 2.8 3.6

Rapeseeds

3.7 3.8 3.3 2.6 3.0

Soybeans

3.2 2.4 2.5 2.3 2.7

Secondly, in previous reporting periods, the company was quite conservative in reflecting financial results from crops in fields revaluation. According to the financial results for the first nine months of 2023, the adjusted EBITDA of the segment was -$32 million. As for year-end results, primarily due to the recovery of the export of Ukrainian agricultural products through the deep-sea ports of Ukraine, segment’s EBITDA amounted to $6 million.

It should be noted that main part of the agricultural products grown by MHP are consumed inside the group (it is the basis for poultry feed production), so the group has the opportunity to re-distribute profits between different segments, making some segments more profitable at the expense of others.

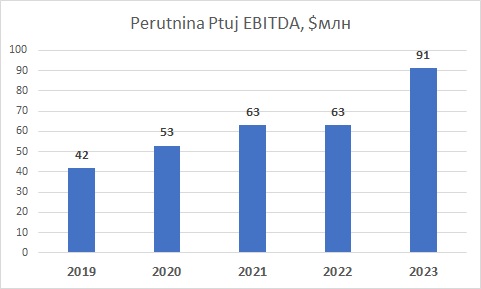

In the European segment for the production of poultry meat (which is separated from other - Ukrainian - segments), the operating and financial results of MHP were quite strong - in 2023, the company increased the production of poultry meat at the capacities of the Slovenian Perutnina Ptuj, segment sales in tons increased in comparison with 2022 by 8% and amounted to 80.5 thousand tons.

The turnover of Perutnina Ptuj for 2023 was $545 million (+17% compared to the previous year), the adjusted EBITDA comprised $91 million (in 2022 - $63 million). From the point of view of pnl, the European segment of MHP takes a significant share in the overall results of the group. It is not surprising that MHP is trying to continue its development and presence in European countries - the company announced an agreement to purchase 81% stake in the business for the production of poultry meat in Albania ($18 million pmvestment).

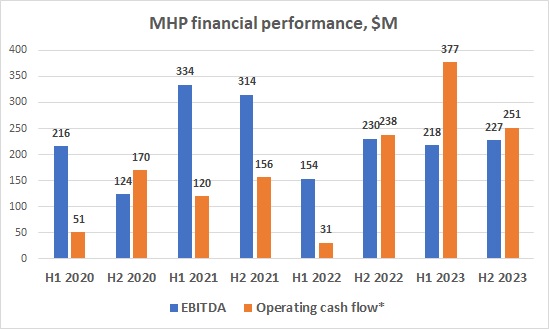

The total adjusted EBITDA of MHP for 2023 was $445 million (in 2022 - $384 million), in the reporting year the company received a net profit in the total amount of $142 million (compared to a net loss in the amount of $231 million in 2022 - primarily due to loss from currency revaluation of liabilities in the amount of $365 million).

A significant increase in the company's operating cash flow is also positive - from $138 million in 2022 to $438 million in 2023. It is important to note that operating cash flow before changes in working capital of MHP in 2023 amounted to $567 million compared to $609 million in 2022).

Apart from the profits, operating cash flow figure in the reporting year was affected by the fact that during the year the amount VAT receivable decreased by $39 million, as well as the fact that in 2023 MHP paid its creditors a significantly larger amount of interest ($178 million vs. $126 million in 2022) - due to the fact that part of the interest which was to be paid in 2022 year, was postponed.

*-operating cash flow before interest and income tax

*-operating cash flow before interest and income tax

In 2023, the company used operating cash flow as follows. $228 million was allocated to investment activities. In addition to signing an agreement to purchase a business in Albania, in September 2023, MHP, together with local partner Tanmiah Food Company, established a joint venture in Saudi Arabia, and continues to explore other development opportunities in the region. Also, in 2023, investments were directed to maintenance, development of MHP as a culinary company and increasing production volumes at Perutnina Ptuj.

Currently, MHP operates 1,555 retail sales points (Doner Market, Meat Market and others), continuing to position itself as, first and foremost, a culinary company.

Also, in 2023, the MHP directed $56 million to repay the debt. At the same time, according to the results of 2022, the company did not pay dividends, and it has already been announced that there will be no dividend payments based on the results of 2023 either.

Due to a significant amount of operating cash flow, the amount of cash on the company's accounts during 2023 increased from $300 million to $436 million.

Separately, we note that it was very important for the further development of the company that MHP managed to refinance its short-term debt obligations.

In general, in recent years, the total debt burden of MHP has been quite significant (as of December 31, 2023, the company's debt was $1.6 billion). But the strength of the company has always been that the main part of the debt was long-term, while the short-term part MHP always managed to refinance.

The problem for the company was that in 2024 it had to repay Eurobonds for a total amount of $500 million, and the possibilities for debt refinancing under wartime conditions were quite limited. With the help of international financial institutions (credit funds were provided by the EBRD, IFC and DFC in the total amount of $480 million), most of the MHP bonds were refinanced. In November 2023, the company bought back (with a 15% discount) bonds with a total face value of $151 million, additionally bonds with a face value of $138 million was bought back in January 2024 (this time the discount was already 5%). The remaining part of the securities was repaid already in May 2024 (on May 10, 2024, the MHP announced the full repayment of the bond issue).

Currently the debt obligations of the MHP consist of the above-mentioned long-term obligations to international financial institutions, as well as Eurobonds due in 2026 and 2029.

For the next two years, the liquidity situation of MHP should remain stable, so the company can foces on further development and investments.

If chicken prices (world and Ukrainian) do not undergo significant changes, it can be expected that the profitability of the company will remain at a stable level, or there will be a non-critical decrease (primarily due to a decrease in the yield of the main crops after the highs of 2023, and as well as a decrease in the volume and profitability of oilseeds crush).

The company's financial results may be positively affected by the increase in grain prices in Ukraine compared to the current fairly low levels (but it is worth noting that the financial results of MHP are much more dependent on chicken prices, as well as the yield of oilseeds and grains, since the main share of the harvest is consumed inside the group).

In general, the financial standing of MHP remains quite stable, the results of operating and financial activities for the reporting year are quite good, but the debt burden continues to be significant.